https://twitter.com/DavidRayAmos/with_replies

![]()

David Raymond Amos @DavidRayAmos

Replying to @DavidRayAmos@Kathryn98967631 and 49 others

I never heard of Marilyn Gladu so I called her to explain why MacKay made my day but her assistant was too busy to check my Twitter account to verify what I was saying was true so I told her to enjoy my email

https://davidraymondamos3.blogspot.com/2020/01/peter-mackay-set-to-enter-conservative.html

#nbpoli#cdnpoli

https://www.cbc.ca/news/politics/mackay-tweets-leadership-1.5427544

![]()

David Raymond Amos @DavidRayAmos

Replying to @DavidRayAmos@Kathryn98967631 and 49 others

Methinks everybody knows why MacKay just made my day Trudeau The Younger cannot deny that Petey Baby answered this lawsuit while Harper was still the boss N'esy Pas?

https://davidraymondamos3.blogspot.com/2015/09/v-behaviorurldefaultvmlo.html

#nbpoli#cdnpoli

https://www.cbc.ca/news/politics/mackay-tweets-leadership-1.5427544

· CBC News· Posted: Jan 15, 2020 12:11 PM ET

![]()

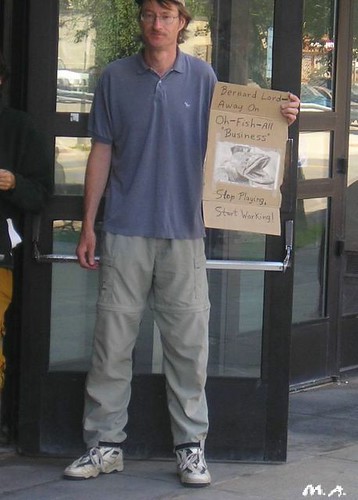

Peter MacKay shakes hands with Conservative Leader Andrew Scheer during a campaign stop in Little Harbour, N.S., October 17, 2019. MacKay, a former cabinet minister in the Harper government, is announcing he's running for the Conservative Party leadership today. (Adrian Wyld/The Canadian Press)

Peter MacKay will confirm that he is jumping into the Conservative leadership with a tweet later today, CBC News has confirmed.

MacKay is expected to formally launch his campaign late next week.

The tweet will publicly confirm work that has been going on behind the scenes for some time. MacKay has recruited former Conservative MP Alex Nuttall as his campaign manager. Nuttall was an organizer for Maxime Bernier during the Conservative leadership race in 2017.

Michael Diamond, who ran Ontario Premier Doug Ford's PC leadership campaign in 2018, will be MacKay's director of communications.

MacKay will be running to lead the party he helped to create. He took the reins of the Progressive Conservative Party and quickly merged it with Stephen Harper's Canadian Alliance to form the Conservative Party in 2003.

And he may well wind up running against a former political mentor, Jean Charest. The ex-premier of Quebec, who led the federal Progressive Conservative party from 1993 to 1998, is said to be considering a run at the Conservative leadership.

MacKay and MP Marilyn Gladu are the only Conservatives to date to publicly signal leadership runs. Gladu is the only caucus member to declare so far, but her colleagues Erin O'Toole and Pierre Poilievre are widely expected to announce soon.

Charest is reportedly close to a decision on a possible leadership run, as is MP Michael Chong, who ran in 2017. Former Conservative interim leader Rona Ambrose is said to be still actively considering a run.

More to come ...

MacKay joins Marilyn Gladu as the second Conservative to formally signal they are entering the race.

CBC's Journalistic Standards and Practices

1213 Comments

David Sampson

But will intelligent "progressive" conservatives ever forgive Peter for giving away a once proud national political institution to a horde of western based reform fundamentalists?

Eugene Peabody

Craig Hall

Reply to @David Sampson: Nobody cares except the Liberals. And David Orchard.

David Raymond Amos

David Linkletter

Angela Kung

Judas returns in a helicopter this time.

Michael Trebych

John McLane

The Conservatives are not a federal party since they have been taken over by the reformers. They are a special interest party controlled by Alberta oil. And after seeing what big oil and the conservatives of Alberta have done to there province of boom and bust I do not want to see them anyware near ottawa, thank you!

Lon Chaney (Alonzo Hastings Chaney)

This dude sold the cons to the reformacons....

Jim Taylor

Ray Boychuk

Wow tough times for conservatives...

Bert Van

Wasn’t it Mac Kay and Toews Who muzzled the RCMP in 2012 and made it impossible for them to speak to MPs without ministerial approval. This is what you get if you vote for this secretive, closed door crew

Angela Kung

---------- Forwarded message ----------

From: "MinFinance / FinanceMin (FIN)"<fin.minfinance-financemin.fin@canada.ca >

Date: Thu, 9 Jan 2020 17:55:17 +0000

Subject: RE: YO Tom Freda Say Hey Sylvie Gadoury the General Counsel

of CBC for me will ya?

To: David Amos <david.raymond.amos333@gmail.com >

The Department of Finance acknowledges receipt of your electronic

correspondence. Please be assured that we appreciate receiving your

comments.

Le ministère des Finances accuse réception de votre correspondance

électronique. Soyez assuré(e) que nous apprécions recevoir vos

commentaires.

On 1/9/20, David Amos <david.raymond.amos333@gmail.com > wrote:

> For media comments or interviews, please contact (phone or text message):

> Tom Freda - (Head Office, Toronto) - (416)705-5660 or

> tfreda@canadian-republic.ca

> Pierre Vincent (Calgary) - (587)834-1964 info@republique-canadienne.ca

> (anglais et en français)

> Kara Cardinal (Vancouver) - info@canadian-republic.ca

> Jamie Bradley (Halifax) - (902) 488-7838 jbradley@canadian-republic.ca

>

> Maritime Noon @CBCMaritimeNoon

> Are you a loyal monarchist, or ready for a republic? Today we're

> asking whether you want Canada to remain a monarchy. 1-800-565-1940

> @MonarchisteCA

> @CanRepublic

>

>

> Enjoy

>

> https://www.sec.gov/Archives/edgar/data/230098/000113031902001603/m08476e18vk.htm

>

>

>

>

> https://www.banking.senate.gov/hearings/review-of-current-investigations-and-regulatory-actions-regarding-the-mutual-fund-industry

>

>

> Review of Current Investigations and Regulatory Actions Regarding the

> Mutual Fund Industry

>

> Date: Thursday, November 20, 2003 Time: 02:00 PM

> Topic

> The Committee will meet in OPEN SESSION to conduct the second in a

> series of hearings on the “Review of Current Investigations and

> Regulatory Actions Regarding the Mutual Fund Industry.”

> Witnesses

> Witness Panel 1

>

> Mr. Stephen M. Cutler

> Director - Division of Enforcement

> Securities and Exchange Commission

> Cutler - November 20, 2003

> Mr. Robert Glauber

> Chairman and CEO

> National Association of Securities Dealers

> Glauber - November 20, 2003

> Eliot Spitzer

> Attorney General

> State of New York

>

>

>

>

> ---------- Original message ----------

> From: Jody.Wilson-Raybould@parl.gc.ca

> Date: Tue, 12 Mar 2019 01:24:19 +0000

> Subject: Automatic reply: RE SNC-Lavalin Trudeau and the OECD Attn Don

> Houle, Denis Jasmin, William McNamara and Stephen LeDrew pursuant to

> my calls you will find this email at the bottom of my blog about you

> dudes

> To: motomaniac333@gmail.com

>

> Thank you for writing to the Honourable Jody Wilson-Raybould, Member

> of Parliament for Vancouver Granville.

>

> This message is to acknowledge that we are in receipt of your email.

> Due to the significant increase in the volume of correspondence, there

> may be a delay in processing your email. Rest assured that your

> message will be carefully reviewed.

>

> To help us address your concerns more quickly, please include within

> the body of your email your full name, address, and postal code.

>

> Thank you

>

> -------------------

>

> Merci d'?crire ? l'honorable Jody Wilson-Raybould, d?put?e de

> Vancouver Granville.

>

> Le pr?sent message vise ? vous informer que nous avons re?u votre

> courriel. En raison d'une augmentation importante du volume de

> correspondance, il pourrait y avoir un retard dans le traitement de

> votre courriel. Sachez que votre message sera examin? attentivement.

>

> Pour nous aider ? r?pondre ? vos pr?occupations plus rapidement,

> veuillez inclure dans le corps de votre courriel votre nom complet,

> votre adresse et votre code postal.

>

> Merci

>

>

>

>

>>

>>

>> ---------- Forwarded message ----------

>> From: Ministerial Correspondence Unit - Justice Canada

>> <mcu@justice.gc.ca>

>> Date: Tue, 26 Feb 2019 17:35:05 +0000

>> Subject: Automatic reply: RE FATCA, the CRA and the IRS YO Donald J.

>> Trump Jr. why does your ex lawyer Mr Cohen and the Canadain FEDS

>> continue lie after all this time???

>> To: David Amos <motomaniac333@gmail.com>

>>

>> Thank you for writing to the Honourable David Lametti, Minister of

>> Justice and Attorney General of Canada.

>>

>> Due to the significant increase in the volume of correspondence

>> addressed to the Minister, please note that there may be a delay in

>> processing your email. Rest assured that your message will be

>> carefully reviewed.

>>

>> We do not respond to correspondence that contains offensive language.

>>

>> -------------------

>>

>> Merci d'avoir écrit à l'honorable David Lametti, ministre de la

>> Justice et procureur général du Canada.

>>

>> En raison d'une augmentation importante du volume de la correspondance

>> adressée au ministre, veuillez prendre note qu'il pourrait y avoir un

>> retard dans le traitement de votre courriel. Nous tenons à vous

>> assurer que votre message sera lu avec soin.

>>

>> Nous ne répondons pas à la correspondance contenant un langage offensant.

>>

>

>

>

>

> ---------- Original message ----------

> From: "LSD / DSJ (JUS/JUS)"<BPIB-DGPAA@justice.gc.ca>

> Date: Wed, 16 Jan 2019 19:25:31 +0000

> Subject: RE: YO Pierre Poilievre I just called and tried to reason

> with David Lametti's minions and got nowhere fast Surprise Surprise

> Surprise N'esy Pas Petev Baby Mackay?

> To: David Amos <motomaniac333@gmail.com>

>

> This confirms receipt of the message that you recently sent to the

> Legal Systems Division or to the Justipedia Team of the Legal

> Practices Branch. We will review your message and reply within

> forty-eight (48) hours. Please do not reply to this email.

>

> ***

>

> La présente confirme réception du message que vous avez fait parvenir

> à la Division des systèmes juridiques ou à l’équipe de Justipédia de

> la Direction générale des pratiques juridiques. Nous réviserons votre

> message et vous répondrons dans les quarante-huit (48) heures. Prière

> de ne pas répondre au présent courriel.

>

>

> ---------- Original message ----------

> From: David Amos <motomaniac333@gmail.com>

> Date: Wed, 16 Jan 2019 15:25:26 -0400

> Subject: Fwd: YO Pierre Poilievre I just called and tried to reason

> with David Lametti's minions and got nowhere fast Surprise Surprise

> Surprise N'esy Pas Petev Baby Mackay?

> To: Support@viafoura.com, darrow.macintyre@cbc.ca,

> carrie@viafoura.com, allison@viafoura.com

> Cc: david.raymond.amos@gmail.com, LPMD-DGPD@justice.gc.ca,

> Mark.Blakely@rcmp-grc.gc.ca, Gilles.Blinn@rcmp-grc.gc.ca

>

>

> ---------- Forwarded message ----------

> From: David Amos <motomaniac333@gmail.com>

> Date: Wed, 16 Jan 2019 15:00:58 -0400

> Subject: YO Pierre Poilievre I just called and tried to reason with

> David Lametti's minions and got nowhere fast Surprise Surprise

> Surprise N'esy Pas Petev Baby Mackay?

> To: pierre.poilievre@parl.gc.ca, olad-dlo@justice.gc.ca,

> David.Lametti.a1@parl.gc.ca, maxime.bernier@parl.gc.ca,

> andrew.scheer@parl.gc.ca, charlie.angus@parl.gc.ca,

> PETER.MACKAY@bakermckenzie.com, tony.clement.a1@parl.gc.ca

> Cc: david.raymond.amos@gmail.com, scott.bardsley@canada.ca,

> scott.brison@parl.gc.ca, scott.macrae@rcmp-grc.gc.ca,

> warren.mcbeath@rcmp-grc.gc.ca, Beverley.Busson@sen.parl.gc.ca

>

> Official Languages Directorate

>

> Telephone: 613-957-4967

> Fax: 613-948-6924

> Email: olad-dlo@justice.gc.ca

> Address: Official Languages Directorate

> Department of Justice Canada

> 350 Albert Street, 3rd floor

> Ottawa, Ontario K1A 0H8

>

> ---------- Original message ----------

> From: Ministerial Correspondence Unit - Justice Canada <mcu@justice.gc.ca>

> Date: Wed, 16 Jan 2019 17:58:23 +0000

> Subject: Automatic reply: C'yall in Court

> To: David Amos <motomaniac333@gmail.com>

>

> Thank you for writing to the Honourable David Lametti, Minister of

> Justice and Attorney General of Canada.

>

> Due to the significant increase in the volume of correspondence

> addressed to the Minister, please note that there may be a delay in

> processing your email. Rest assured that your message will be

> carefully reviewed.

>

> -------------------

>

> Merci d'avoir écrit à l'honorable David Lametti, ministre de la

> Justice et procureur général du Canada.

>

> En raison d'une augmentation importante du volume de la correspondance

> adressée à la ministre, veuillez prendre note qu'il pourrait y avoir

> un retard dans le traitement de votre courriel. Nous tenons à vous

> assurer que votre message sera lu avec soin.

>

>

> ---------- Original message ----------

> From: Ministerial Correspondence Unit - Justice Canada <mcu@justice.gc.ca>

> Date: Tue, 15 Jan 2019 22:18:45 +0000

> Subject: Automatic reply: Methinks David Lametti should go back to law

> school too N'esy Pas Pierre Poilievre?

> To: David Amos <motomaniac333@gmail.com>

>

> Thank you for writing to the Honourable David Lametti, Minister of

> Justice and Attorney General of Canada.

>

> Due to the significant increase in the volume of correspondence

> addressed to the Minister, please note that there may be a delay in

> processing your email. Rest assured that your message will be

> carefully reviewed.

>

> -------------------

>

> Merci d'avoir écrit à l'honorable David Lametti, ministre de la

> Justice et procureur général du Canada.

>

> En raison d'une augmentation importante du volume de la correspondance

> adressée à la ministre, veuillez prendre note qu'il pourrait y avoir

> un retard dans le traitement de votre courriel. Nous tenons à vous

> assurer que votre message sera lu avec soin.

>

>

>

> ---------- Forwarded message ----------

> From: Jody.Wilson-Raybould@parl.gc.ca

> Date: Tue, 15 Jan 2019 22:18:49 +0000

> Subject: Automatic reply: Methinks David Lametti should go back to law

> school too N'esy Pas Pierre Poilievre?

> To: motomaniac333@gmail.com

>

> Thank you for writing to the Honourable Jody Wilson-Raybould, Member

> of Parliament for Vancouver Granville.

>

> This message is to acknowledge that we are in receipt of your email.

> Due to the significant increase in the volume of correspondence, there

> may be a delay in processing your email. Rest assured that your

> message will be carefully reviewed.

>

> To help us address your concerns more quickly, please include within

> the body of your email your full name, address, and postal code.

>

>

>

> Thank you

>

> -------------------

>

> Merci d'?crire ? l'honorable Jody Wilson-Raybould, d?put?e de

> Vancouver Granville.

>

> Le pr?sent message vise ? vous informer que nous avons re?u votre

> courriel. En raison d'une augmentation importante du volume de

> correspondance, il pourrait y avoir un retard dans le traitement de

> votre courriel. Sachez que votre message sera examin? attentivement.

>

> Pour nous aider ? r?pondre ? vos pr?occupations plus rapidement,

> veuillez inclure dans le corps de votre courriel votre nom complet,

> votre adresse et votre code postal.

>

>

>

> Merci

>

>

>

> ---------- Forwarded message ----------

> From: michael.chong@parl.gc.ca

> Date: Tue, 15 Jan 2019 22:18:49 +0000

> Subject: Automatic reply: Methinks David Lametti should go back to law

> school too N'esy Pas Pierre Poilievre?

> To: motomaniac333@gmail.com

>

> Thanks very much for getting in touch with me!

>

> This email is to acknowledge receipt of your message and to let you

> know that every incoming email is read and reviewed. A member of my

> Wellington-Halton Hills team will be in touch with you shortly if

> follow-up is required.

> Due to the high volume of email correspondence, priority is given to

> responding to residents of Wellington-Halton Hills and to emails of a

> non-chain (or "forwards") variety.

>

> In your email, if you:

>

> * have verified that you are a constituent by including your

> complete residential postal address and a phone number, a response

> will be provided in a timely manner.

> * have not included your residential postal mailing address,

> please resend your email with your complete residential postal address

> and phone number, and a response will be forthcoming.

>

> If you are not a constituent of Wellington Halton-Hills, please

> contact your Member of Parliament. If you are unsure who your MP is,

> you can find them by searching your postal code at

> http://www.ourcommons.ca/en

>

> Any constituents of Wellington-Halton Hills who require urgent

> attention are encouraged to call the constituency office at

> 1-866-878-5556 (toll-free in riding). Please rest assured that any

> voicemails will be returned promptly.

>

> Once again, thank you for your email.

>

> The Hon. Michael Chong, M.P.

> Wellington-Halton Hills

> toll free riding office:1-866-878-5556

> Ottawa office: 613-992-4179

> E-mail: michael.chong@parl.gc.ca<mailto:michael.chong@parl.gc.ca >

> Website : www.michaelchong.ca<http://www.michaelchong.ca >

>

> THIS MESSAGE IS ONLY INTENDED FOR THE USE OF THE INTENDED RECIPIENT(S)

> AND MAY CONTAIN INFORMATION THAT IS PRIVILEGED, PROPRIETARY AND/OR

> CONFIDENTIAL. If you are not the intended recipient, you are hereby

> notified that any review, retransmission, dissemination, distribution,

> copying, conversion to hard copy or other use of this communication is

> strictly prohibited. If you are not the intended recipient and have

> received this message in error, please notify me by return e-mail and

> delete this message from your system.

>

>

>

> ---------- Forwarded message ----------

> From: David Amos <motomaniac333@gmail.com>

> Date: Tue, 15 Jan 2019 18:18:40 -0400

> Subject: Methinks David Lametti should go back to law school too N'esy

> Pas Pierre Poilievre?

> To: David.Lametti@parl.gc.ca, Jody.Wilson-Raybould@parl.gc.ca ,

> pierre.poilievre@parl.gc.ca,mcu@justice.gc.ca ,

> michael.chong@parl.gc.ca, Michael.Wernick@pco-bcp.gc.ca

> Cc: david.raymond.amos@gmail.com, Newsroom@globeandmail.com,

> Jacques.Poitras@cbc.ca, serge.rousselle@gnb.ca

>

>

> ---------- Forwarded message ----------

> From: David Amos <motomaniac333@gmail.com>

> Date: Mon, 14 Jan 2019 15:44:16 -0400

> Subject: Jagmeet Singh says that maybe Jay Shin should go back to law

> school??? Too Too Funny Indeed EH Karen Wang and Laura-Lynn Tyler

> Thompson?

> To: info@jayshin.ca, jay@lonsdalelaw.ca, karenwang@liberal.ca,

> lauralynnlive@gmail.com

> Cc: David Amos <david.raymond.amos@gmail.com>,

> jmaclellan@burnabynow.com, kgawley@burnabynow.com

>

> Jagmeet Singh on Tory opponent: 'Maybe he should go back to law school'

> Conservative candidate Jay Shin said Singh was 'keeping criminals out

> of jail' during his days as a criminal defence lawyer

> Kelvin Gawley Burnaby Now January 13, 2019 10:27 AM

>

> Julie MacLellan

> Assistant editor, and newsroom tip line

> jmaclellan@burnabynow.com

> Phone: 604 444 3020

> Kelvin Gawley

> kgawley@burnabynow.com

> Phone: 604 444 3024

>

> Jay Shin

> Direct: 604-980-5089

> Email: jay@lonsdalelaw.ca

> By phone: 604-628-0508

> By e-mail: info@jayshin.ca

>

> Karen Wang

> 604.531.1178

> karenwang@liberal.ca

>

> Now if Mr Shin scrolls down he will know some of what the fancy NDP

> lawyer has known for quite sometime

>

> ---------- Forwarded message ----------

> From: "Singh - QP, Jagmeet"<JSingh-QP@ndp.on.ca>

> Date: Fri, 19 May 2017 16:39:35 +0000

> Subject: Automatic reply: Re Federal Court File # T-1557-15 and the

> upcoming hearing on May 24th I called a lot of your people before High

> Noon today Correct Ralph Goodale and Deputy Minister Malcolm Brown?

> To: David Amos <motomaniac333@gmail.com>

>

>

> For immediate assistance please contact our Brampton office at

> 905-799-3939 or jsingh-co@ndp.on.ca

>

>

> ---------- Forwarded message ----------

> From: Kennedy.Stewart@parl.gc.ca

> Date: Fri, 19 Oct 2018 18:18:35 +0000

> Subject: Automatic reply: Attn Minister Ralph Goodale and Pierre

> Paul-Hus Trust that I look forward to arguing the fact that fhe Crown

> filed my Sept 4th email to you and your buddies

> To: motomaniac333@gmail.com

>

> Many thanks for your message. Your concerns are important to me. If

> your matter is urgent, an invitation or an immigration matter please

> forward it to burnabysouth.A1@parl.gc.ca or

> burnabysouth.C1@parl.gc.ca. This email is no longer being monitored.

>

> The House of Commons of Canada provides for the continuation of

> services to the constituents of a Member of Parliament whose seat has

> become vacant. The party Whip supervises the staff retained under

> these circumstances.

>

> Following the resignation of the Member for the constituency of

> Burnaby South, Mr. Kennedy Stewart, the constituency office will

> continue to provide services to constituents.

>

> You can reach the Burnaby South constituency office by telephone at

> (604) 291-8863 or by mail at the following address: 4940 Kingsway,

> Burnaby BC.

>

> Office Hours:

>

> Tuesday - Thursday: 10am - 12pm & 1pm - 4pm

> Friday 10am - 12pm

>

>

>

>

> ---------- Forwarded message ----------

> From: Michael Cohen <mcohen@trumporg.com>

> Date: Thu, 11 Jan 2018 05:54:40 +0000

> Subject: Automatic reply: ATTN Blair Armitage You acted as the Usher

> of the Black Rod twice while Kevin Vickers was the Sergeant-at-Arms

> Hence you and the RCMP must know why I sued the Queen Correct?

> To: David Amos <motomaniac333@gmail.com>

>

> Effective January 20, 2017, I have accepted the role as personal

> counsel to President Donald J. Trump. All future emails should be

> directed to mdcohen212@gmail.com and all future calls should be

> directed to 646-853-0114.

> ________________________________

> This communication is from The Trump Organization or an affiliate

> thereof and is not sent on behalf of any other individual or entity.

> This email may contain information that is confidential and/or

> proprietary. Such information may not be read, disclosed, used,

> copied, distributed or disseminated except (1) for use by the intended

> recipient or (2) as expressly authorized by the sender. If you have

> received this communication in error, please immediately delete it and

> promptly notify the sender. E-mail transmission cannot be guaranteed

> to be received, secure or error-free as emails could be intercepted,

> corrupted, lost, destroyed, arrive late, incomplete, contain viruses

> or otherwise. The Trump Organization and its affiliates do not

> guarantee that all emails will be read and do not accept liability for

> any errors or omissions in emails. Any views or opinions presented in

> any email are solely those of the author and do not necessarily

> represent those of The Trump Organization or any of its affiliates.

> Nothing in this communication is intended to operate as an electronic

> signature under applicable law.

>

>

>

> ---------- Forwarded message ----------

> From: Justice Website <JUSTWEB@novascotia.ca>

> Date: Mon, 18 Sep 2017 14:21:11 +0000

> Subject: Emails to Department of Justice and Province of Nova Scotia

> To: "motomaniac333@gmail.com"<motomaniac333@gmail.com>

>

> Mr. Amos,

> We acknowledge receipt of your recent emails to the Deputy Minister of

> Justice and lawyers within the Legal Services Division of the

> Department of Justice respecting a possible claim against the Province

> of Nova Scotia. Service of any documents respecting a legal claim

> against the Province of Nova Scotia may be served on the Attorney

> General at 1690 Hollis Street, Halifax, NS. Please note that we will

> not be responding to further emails on this matter.

>

> Department of Justice

>

>

>> ---------- Forwarded message ----------

>> From: David Amos motomaniac333@gmail.com

>> Date: Mon, 12 Jun 2017 09:32:09 -0400

>> Subject: Attn Integrity Commissioner Alexandre Deschênes, Q.C.,

>> To: coi@gnb.ca

>> Cc: david.raymond.amos@gmail.com

>>

>> Good Day Sir

>>

>> After I heard you speak on CBC I called your office again and managed

>> to speak to one of your staff for the first time

>>

>> Please find attached the documents I promised to send to the lady who

>> answered the phone this morning. Please notice that not after the Sgt

>> at Arms took the documents destined to your office his pal Tanker

>> Malley barred me in writing with an "English" only document.

>>

>> These are the hearings and the dockets in Federal Court that I

>> suggested that you study closely.

>>

>> This is the docket in Federal Court

>>

>> http://cas-cdc-www02.cas-satj.gc.ca/IndexingQueries/infp_RE_info_e.php?court_no=T-1557-15&select_court=T

>>

>> These are digital recordings of the last three hearings

>>

>> Dec 14th https://archive.org/details/BahHumbug

>>

>> January 11th, 2016 https://archive.org/details/Jan11th2015

>>

>> April 3rd, 2017

>>

>> https://archive.org/details/April32017JusticeLeblancHearing

>>

>>

>> This is the docket in the Federal Court of Appeal

>>

>> http://cas-cdc-www02.cas-satj.gc.ca/IndexingQueries/infp_RE_info_e.php?court_no=A-48-16&select_court=All

>>

>>

>> The only hearing thus far

>>

>> May 24th, 2017

>>

>> https://archive.org/details/May24thHoedown

>>

>>

>> This Judge understnds the meaning of the word Integrity

>>

>> Date: 20151223

>>

>> Docket: T-1557-15

>>

>> Fredericton, New Brunswick, December 23, 2015

>>

>> PRESENT: The Honourable Mr. Justice Bell

>>

>> BETWEEN:

>>

>> DAVID RAYMOND AMOS

>>

>> Plaintiff

>>

>> and

>>

>> HER MAJESTY THE QUEEN

>>

>> Defendant

>>

>> ORDER

>>

>> (Delivered orally from the Bench in Fredericton, New Brunswick, on

>> December 14, 2015)

>>

>> The Plaintiff seeks an appeal de novo, by way of motion pursuant to

>> the Federal Courts Rules (SOR/98-106), from an Order made on November

>> 12, 2015, in which Prothonotary Morneau struck the Statement of Claim

>> in its entirety.

>>

>> At the outset of the hearing, the Plaintiff brought to my attention a

>> letter dated September 10, 2004, which he sent to me, in my then

>> capacity as Past President of the New Brunswick Branch of the Canadian

>> Bar Association, and the then President of the Branch, Kathleen Quigg,

>> (now a Justice of the New Brunswick Court of Appeal). In that letter

>> he stated:

>>

>> As for your past President, Mr. Bell, may I suggest that you check the

>> work of Frank McKenna before I sue your entire law firm including you.

>> You are your brother’s keeper.

>>

>> Frank McKenna is the former Premier of New Brunswick and a former

>> colleague of mine at the law firm of McInnes Cooper. In addition to

>> expressing an intention to sue me, the Plaintiff refers to a number of

>> people in his Motion Record who he appears to contend may be witnesses

>> or potential parties to be added. Those individuals who are known to

>> me personally, include, but are not limited to the former Prime

>> Minister of Canada, The Right Honourable Stephen Harper; former

>> Attorney General of Canada and now a Justice of the Manitoba Court of

>> Queen’s Bench, Vic Toews; former member of Parliament Rob Moore;

>> former Director of Policing Services, the late Grant Garneau; former

>> Chief of the Fredericton Police Force, Barry McKnight; former Staff

>> Sergeant Danny Copp; my former colleagues on the New Brunswick Court

>> of Appeal, Justices Bradley V. Green and Kathleen Quigg, and, retired

>> Assistant Commissioner Wayne Lang of the Royal Canadian Mounted

>> Police.

>>

>> In the circumstances, given the threat in 2004 to sue me in my

>> personal capacity and my past and present relationship with many

>> potential witnesses and/or potential parties to the litigation, I am

>> of the view there would be a reasonable apprehension of bias should I

>> hear this motion. See Justice de Grandpré’s dissenting judgment in

>> Committee for Justice and Liberty et al v National Energy Board et al,

>> [1978] 1 SCR 369 at p 394 for the applicable test regarding

>> allegations of bias. In the circumstances, although neither party has

>> requested I recuse myself, I consider it appropriate that I do so.

>>

>>

>> AS A RESULT OF MY RECUSAL, THIS COURT ORDERS that the Administrator of

>> the Court schedule another date for the hearing of the motion. There

>> is no order as to costs.

>>

>> “B. Richard Bell”

>> Judge

>>

>>

>> Below after the CBC article about your concerns (I made one comment

>> already) you will find the text of just two of many emails I had sent

>> to your office over the years since I first visited it in 2006.

>>

>> I noticed that on July 30, 2009, he was appointed to the the Court

>> Martial Appeal Court of Canada Perhaps you should scroll to the

>> bottom of this email ASAP and read the entire Paragraph 83 of my

>> lawsuit now before the Federal Court of Canada?

>>

>> "FYI This is the text of the lawsuit that should interest Trudeau the

>> most

>>

>>

>> ---------- Original message ----------

>> From: justin.trudeau.a1@parl.gc.ca

>> Date: Thu, Oct 22, 2015 at 8:18 PM

>> Subject: Réponse automatique : RE My complaint against the CROWN in

>> Federal Court Attn David Hansen and Peter MacKay If you planning to

>> submit a motion for a publication ban on my complaint trust that you

>> dudes are way past too late

>> To: david.raymond.amos@gmail.com

>>

>> Veuillez noter que j'ai changé de courriel. Vous pouvez me rejoindre à

>> lalanthier@hotmail.com

>>

>> Pour rejoindre le bureau de M. Trudeau veuillez envoyer un courriel à

>> tommy.desfosses@parl.gc.ca

>>

>> Please note that I changed email address, you can reach me at

>> lalanthier@hotmail.com

>>

>> To reach the office of Mr. Trudeau please send an email to

>> tommy.desfosses@parl.gc.ca

>>

>> Thank you,

>>

>> Merci ,

>>

>>

>> http://davidraymondamos3.blogspot.ca/2015/09/v-behaviorurldefaultvmlo.html

>>

>>

>> 83. The Plaintiff states that now that Canada is involved in more war

>> in Iraq again it did not serve Canadian interests and reputation to

>> allow Barry Winters to publish the following words three times over

>> five years after he began his bragging:

>>

>> January 13, 2015

>> This Is Just AS Relevant Now As When I wrote It During The Debate

>>

>> December 8, 2014

>> Why Canada Stood Tall!

>>

>> Friday, October 3, 2014

>> Little David Amos’ “True History Of War” Canadian Airstrikes And

>> Stupid Justin Trudeau

>>

>> Canada’s and Canadians free ride is over. Canada can no longer hide

>> behind Amerka’s and NATO’s skirts.

>>

>> When I was still in Canadian Forces then Prime Minister Jean Chretien

>> actually committed the Canadian Army to deploy in the second campaign

>> in Iraq, the Coalition of the Willing. This was against or contrary to

>> the wisdom or advice of those of us Canadian officers that were

>> involved in the initial planning phases of that operation. There were

>> significant concern in our planning cell, and NDHQ about of the dearth

>> of concern for operational guidance, direction, and forces for

>> operations after the initial occupation of Iraq. At the “last minute”

>> Prime Minister Chretien and the Liberal government changed its mind.

>> The Canadian government told our amerkan cousins that we would not

>> deploy combat troops for the Iraq campaign, but would deploy a

>> Canadian Battle Group to Afghanistan, enabling our amerkan cousins to

>> redeploy troops from there to Iraq. The PMO’s thinking that it was

>> less costly to deploy Canadian Forces to Afghanistan than Iraq. But

>> alas no one seems to remind the Liberals of Prime Minister Chretien’s

>> then grossly incorrect assumption. Notwithstanding Jean Chretien’s

>> incompetence and stupidity, the Canadian Army was heroic,

>> professional, punched well above it’s weight, and the PPCLI Battle

>> Group, is credited with “saving Afghanistan” during the Panjway

>> campaign of 2006.

>>

>> What Justin Trudeau and the Liberals don’t tell you now, is that then

>> Liberal Prime Minister Jean Chretien committed, and deployed the

>> Canadian army to Canada’s longest “war” without the advice, consent,

>> support, or vote of the Canadian Parliament.

>>

>> What David Amos and the rest of the ignorant, uneducated, and babbling

>> chattering classes are too addled to understand is the deployment of

>> less than 75 special operations troops, and what is known by planners

>> as a “six pac cell” of fighter aircraft is NOT the same as a

>> deployment of a Battle Group, nor a “war” make.

>>

>> The Canadian Government or The Crown unlike our amerkan cousins have

>> the “constitutional authority” to commit the Canadian nation to war.

>> That has been recently clearly articulated to the Canadian public by

>> constitutional scholar Phillippe Legasse. What Parliament can do is

>> remove “confidence” in The Crown’s Government in a “vote of

>> non-confidence.” That could not happen to the Chretien Government

>> regarding deployment to Afghanistan, and it won’t happen in this

>> instance with the conservative majority in The Commons regarding a

>> limited Canadian deployment to the Middle East.

>>

>> President George Bush was quite correct after 911 and the terror

>> attacks in New York; that the Taliban “occupied” and “failed state”

>> Afghanistan was the source of logistical support, command and control,

>> and training for the Al Quaeda war of terror against the world. The

>> initial defeat, and removal from control of Afghanistan was vital and

>>

>> P.S. Whereas this CBC article is about your opinion of the actions of

>> the latest Minister Of Health trust that Mr Boudreau and the CBC have

>> had my files for many years and the last thing they are is ethical.

>> Ask his friends Mr Murphy and the RCMP if you don't believe me.

>>

>> Subject:

>> Date: Tue, 30 Jan 2007 12:02:35 -0400

>> From: "Murphy, Michael B. \(DH/MS\)"MichaelB.Murphy@gnb.ca

>> To: motomaniac_02186@yahoo.com

>>

>> January 30, 2007

>>

>> WITHOUT PREJUDICE

>>

>> Mr. David Amos

>>

>> Dear Mr. Amos:

>>

>> This will acknowledge receipt of a copy of your e-mail of December 29,

>> 2006 to Corporal Warren McBeath of the RCMP.

>>

>> Because of the nature of the allegations made in your message, I have

>> taken the measure of forwarding a copy to Assistant Commissioner Steve

>> Graham of the RCMP “J” Division in Fredericton.

>>

>> Sincerely,

>>

>> Honourable Michael B. Murphy

>> Minister of Health

>>

>> CM/cb

>>

>>

>> Warren McBeath warren.mcbeath@rcmp-grc.gc.ca wrote:

>>

>> Date: Fri, 29 Dec 2006 17:34:53 -0500

>> From: "Warren McBeath"warren.mcbeath@rcmp-grc.gc.ca

>> To: kilgoursite@ca.inter.net, MichaelB.Murphy@gnb.ca,

>> nada.sarkis@gnb.ca, wally.stiles@gnb.ca, dwatch@web.net,

>> motomaniac_02186@yahoo.com

>> CC: ottawa@chuckstrahl.com, riding@chuckstrahl.com,John.Foran@gnb.ca ,

>> Oda.B@parl.gc.ca,"Bev BUSSON"bev.busson@rcmp-grc.gc.ca,

>> "Paul Dube"PAUL.DUBE@rcmp-grc.gc.ca

>> Subject: Re: Remember me Kilgour? Landslide Annie McLellan has

>> forgotten me but the crooks within the RCMP have not

>>

>> Dear Mr. Amos,

>>

>> Thank you for your follow up e-mail to me today. I was on days off

>> over the holidays and returned to work this evening. Rest assured I

>> was not ignoring or procrastinating to respond to your concerns.

>>

>> As your attachment sent today refers from Premier Graham, our position

>> is clear on your dead calf issue: Our forensic labs do not process

>> testing on animals in cases such as yours, they are referred to the

>> Atlantic Veterinary College in Charlottetown who can provide these

>> services. If you do not choose to utilize their expertise in this

>> instance, then that is your decision and nothing more can be done.

>>

>> As for your other concerns regarding the US Government, false

>> imprisonment and Federal Court Dates in the US, etc... it is clear

>> that Federal authorities are aware of your concerns both in Canada

>> the US. These issues do not fall into the purvue of Detachment

>> and policing in Petitcodiac, NB.

>>

>> It was indeed an interesting and informative conversation we had on

>> December 23rd, and I wish you well in all of your future endeavors.

>>

>> Sincerely,

>>

>> Warren McBeath, Cpl.

>> GRC Caledonia RCMP

>> Traffic Services NCO

>> Ph: (506) 387-2222

>> Fax: (506) 387-4622

>> E-mail warren.mcbeath@rcmp-grc.gc.ca

>>

>>

>>

>> Alexandre Deschênes, Q.C.,

>> Office of the Integrity Commissioner

>> Edgecombe House, 736 King Street

>> Fredericton, N.B. CANADA E3B 5H1

>> tel.: 506-457-7890

>> fax: 506-444-5224

>> e-mail:coi@gnb.ca

>>

>

>

> On 8/3/17, David Amos <motomaniac333@gmail.com> wrote:

>

>> If want something very serious to download and laugh at as well Please

>> Enjoy and share real wiretap tapes of the mob

>>

>> http://thedavidamosrant.blogspot.ca/2013/10/re-glen-greenwald-and-braz

>> ilian.html

>>

>>> http://www.cbc.ca/news/world/story/2013/06/09/nsa-leak-guardian.html

>>>

>>> As the CBC etc yap about Yankee wiretaps and whistleblowers I must

>>> ask them the obvious question AIN'T THEY FORGETTING SOMETHING????

>>>

>>> http://www.youtube.com/watch?v=vugUalUO8YY

>>>

>>> What the hell does the media think my Yankee lawyer served upon the

>>> USDOJ right after I ran for and seat in the 39th Parliament baseball

>>> cards?

>>>

>>> http://archive.org/details/ITriedToExplainItToAllMaritimersInEarly200

>>> 6

>>>

>>> http://davidamos.blogspot.ca/2006/05/wiretap-tapes-impeach-bush.html

>>>

>>> http://www.archive.org/details/PoliceSurveilanceWiretapTape139

>>>

>>> http://archive.org/details/Part1WiretapTape143

>>>

>>> FEDERAL EXPRES February 7, 2006

>>> Senator Arlen Specter

>>> United States Senate

>>> Committee on the Judiciary

>>> 224 Dirksen Senate Office Building

>>> Washington, DC 20510

>>>

>>> Dear Mr. Specter:

>>>

>>> I have been asked to forward the enclosed tapes to you from a man

>>> named, David Amos, a Canadian citizen, in connection with the matters

>>> raised in the attached letter.

>>>

>>> Mr. Amos has represented to me that these are illegal FBI wire tap

>>> tapes.

>>>

>>> I believe Mr. Amos has been in contact with you about this previously.

>>>

>>> Very truly yours,

>>> Barry A. Bachrach

>>> Direct telephone: (508) 926-3403

>>> Direct facsimile: (508) 929-3003

>>> Email: bbachrach@bowditch.com

>>>

>>

>

> http://davidraymondamos3.blogspot.ca/2017/11/federal-court-of-appeal-finally-makes.html

>

>

> Sunday, 19 November 2017

> Federal Court of Appeal Finally Makes The BIG Decision And Publishes

> It Now The Crooks Cannot Take Back Ticket To Try Put My Matter Before

> The Supreme Court

>

> https://decisions.fct-cf.gc.ca/fca-caf/decisions/en/item/236679/index.do

>

>

> Federal Court of Appeal Decisions

>

> Amos v. Canada

> Court (s) Database

>

> Federal Court of Appeal Decisions

> Date

>

> 2017-10-30

> Neutral citation

>

> 2017 FCA 213

> File numbers

>

> A-48-16

> Date: 20171030

>

> Docket: A-48-16

> Citation: 2017 FCA 213

> CORAM:

>

> WEBB J.A.

> NEAR J.A.

> GLEASON J.A.

>

>

> BETWEEN:

> DAVID RAYMOND AMOS

> Respondent on the cross-appeal

> (and formally Appellant)

> and

> HER MAJESTY THE QUEEN

> Appellant on the cross-appeal

> (and formerly Respondent)

> Heard at Fredericton, New Brunswick, on May 24, 2017.

> Judgment delivered at Ottawa, Ontario, on October 30, 2017.

> REASONS FOR JUDGMENT BY:

>

> THE COURT

>

>

>

> Date: 20171030

>

> Docket: A-48-16

> Citation: 2017 FCA 213

> CORAM:

>

> WEBB J.A.

> NEAR J.A.

> GLEASON J.A.

>

>

> BETWEEN:

> DAVID RAYMOND AMOS

> Respondent on the cross-appeal

> (and formally Appellant)

> and

> HER MAJESTY THE QUEEN

> Appellant on the cross-appeal

> (and formerly Respondent)

> REASONS FOR JUDGMENT BY THE COURT

>

> I. Introduction

>

> [1] On September 16, 2015, David Raymond Amos (Mr. Amos)

> filed a 53-page Statement of Claim (the Claim) in Federal Court

> against Her Majesty the Queen (the Crown). Mr. Amos claims $11 million

> in damages and a public apology from the Prime Minister and Provincial

> Premiers for being illegally barred from accessing parliamentary

> properties and seeks a declaration from the Minister of Public Safety

> that the Canadian Government will no longer allow the Royal Canadian

> Mounted Police (RCMP) and Canadian Forces to harass him and his clan

> (Claim at para. 96).

>

> [2] On November 12, 2015 (Docket T-1557-15), by way of a

> motion brought by the Crown, a prothonotary of the Federal Court (the

> Prothonotary) struck the Claim in its entirety, without leave to

> amend, on the basis that it was plain and obvious that the Claim

> disclosed no reasonable claim, the Claim was fundamentally vexatious,

> and the Claim could not be salvaged by way of further amendment (the

> Prothontary’s Order).

>

>

> [3] On January 25, 2016 (2016 FC 93), by way of Mr.

> Amos’ appeal from the Prothonotary’s Order, a judge of the Federal

> Court (the Judge), reviewing the matter de novo, struck all of Mr.

> Amos’ claims for relief with the exception of the claim for damages

> for being barred by the RCMP from the New Brunswick legislature in

> 2004 (the Federal Court Judgment).

>

>

> [4] Mr. Amos appealed and the Crown cross-appealed the

> Federal Court Judgment. Further to the issuance of a Notice of Status

> Review, Mr. Amos’ appeal was dismissed for delay on December 19, 2016.

> As such, the only matter before this Court is the Crown’s

> cross-appeal.

>

>

> II. Preliminary Matter

>

> [5] Mr. Amos, in his memorandum of fact and law in

> relation to the cross-appeal that was filed with this Court on March

> 6, 2017, indicated that several judges of this Court, including two of

> the judges of this panel, had a conflict of interest in this appeal.

> This was the first time that he identified the judges whom he believed

> had a conflict of interest in a document that was filed with this

> Court. In his notice of appeal he had alluded to a conflict with

> several judges but did not name those judges.

>

> [6] Mr. Amos was of the view that he did not have to

> identify the judges in any document filed with this Court because he

> had identified the judges in various documents that had been filed

> with the Federal Court. In his view the Federal Court and the Federal

> Court of Appeal are the same court and therefore any document filed in

> the Federal Court would be filed in this Court. This view is based on

> subsections 5(4) and 5.1(4) of the Federal Courts Act, R.S.C., 1985,

> c. F-7:

>

>

> 5(4) Every judge of the Federal Court is, by virtue of his or her

> office, a judge of the Federal Court of Appeal and has all the

> jurisdiction, power and authority of a judge of the Federal Court of

> Appeal.

> […]

>

> 5(4) Les juges de la Cour fédérale sont d’office juges de la Cour

> d’appel fédérale et ont la même compétence et les mêmes pouvoirs que

> les juges de la Cour d’appel fédérale.

> […]

> 5.1(4) Every judge of the Federal Court of Appeal is, by virtue of

> that office, a judge of the Federal Court and has all the

> jurisdiction, power and authority of a judge of the Federal Court.

>

> 5.1(4) Les juges de la Cour d’appel fédérale sont d’office juges de la

> Cour fédérale et ont la même compétence et les mêmes pouvoirs que les

> juges de la Cour fédérale.

>

>

> [7] However, these subsections only provide that the

> judges of the Federal Court are also judges of this Court (and vice

> versa). It does not mean that there is only one court. If the Federal

> Court and this Court were one Court, there would be no need for this

> section.

> [8] Sections 3 and 4 of the Federal Courts Act provide that:

> 3 The division of the Federal Court of Canada called the Federal Court

> — Appeal Division is continued under the name “Federal Court of

> Appeal” in English and “Cour d’appel fédérale” in French. It is

> continued as an additional court of law, equity and admiralty in and

> for Canada, for the better administration of the laws of Canada and as

> a superior court of record having civil and criminal jurisdiction.

>

> 3 La Section d’appel, aussi appelée la Cour d’appel ou la Cour d’appel

> fédérale, est maintenue et dénommée « Cour d’appel fédérale » en

> français et « Federal Court of Appeal » en anglais. Elle est maintenue

> à titre de tribunal additionnel de droit, d’equity et d’amirauté du

> Canada, propre à améliorer l’application du droit canadien, et

> continue d’être une cour supérieure d’archives ayant compétence en

> matière civile et pénale.

> 4 The division of the Federal Court of Canada called the Federal Court

> — Trial Division is continued under the name “Federal Court” in

> English and “Cour fédérale” in French. It is continued as an

> additional court of law, equity and admiralty in and for Canada, for

> the better administration of the laws of Canada and as a superior

> court of record having civil and criminal jurisdiction.

>

> 4 La section de la Cour fédérale du Canada, appelée la Section de

> première instance de la Cour fédérale, est maintenue et dénommée «

> Cour fédérale » en français et « Federal Court » en anglais. Elle est

> maintenue à titre de tribunal additionnel de droit, d’equity et

> d’amirauté du Canada, propre à améliorer l’application du droit

> canadien, et continue d’être une cour supérieure d’archives ayant

> compétence en matière civile et pénale.

>

>

> [9] Sections 3 and 4 of the Federal Courts Act create

> two separate courts – this Court (section 3) and the Federal Court

> (section 4). If, as Mr. Amos suggests, documents filed in the Federal

> Court were automatically also filed in this Court, then there would no

> need for the parties to prepare and file appeal books as required by

> Rules 343 to 345 of the Federal Courts Rules, SOR/98-106 in relation

> to any appeal from a decision of the Federal Court. The requirement to

> file an appeal book with this Court in relation to an appeal from a

> decision of the Federal Court makes it clear that the only documents

> that will be before this Court are the documents that are part of that

> appeal book.

>

>

> [10] Therefore, the memorandum of fact and law filed on

> March 6, 2017 is the first document, filed with this Court, in which

> Mr. Amos identified the particular judges that he submits have a

> conflict in any matter related to him.

>

>

> [11] On April 3, 2017, Mr. Amos attempted to bring a motion

> before the Federal Court seeking an order “affirming or denying the

> conflict of interest he has” with a number of judges of the Federal

> Court. A judge of the Federal Court issued a direction noting that if

> Mr. Amos was seeking this order in relation to judges of the Federal

> Court of Appeal, it was beyond the jurisdiction of the Federal Court.

> Mr. Amos raised the Federal Court motion at the hearing of this

> cross-appeal. The Federal Court motion is not a motion before this

> Court and, as such, the submissions filed before the Federal Court

> will not be entertained. As well, since this was a motion brought

> before the Federal Court (and not this Court), any documents filed in

> relation to that motion are not part of the record of this Court.

>

>

> [12] During the hearing of the appeal Mr. Amos alleged that

> the third member of this panel also had a conflict of interest and

> submitted some documents that, in his view, supported his claim of a

> conflict. Mr. Amos, following the hearing of his appeal, was also

> afforded the opportunity to provide a brief summary of the conflict

> that he was alleging and to file additional documents that, in his

> view, supported his allegations. Mr. Amos submitted several pages of

> documents in relation to the alleged conflicts. He organized the

> documents by submitting a copy of the biography of the particular

> judge and then, immediately following that biography, by including

> copies of the documents that, in his view, supported his claim that

> such judge had a conflict.

>

>

> [13] The nature of the alleged conflict of Justice Webb is

> that before he was appointed as a Judge of the Tax Court of Canada in

> 2006, he was a partner with the law firm Patterson Law, and before

> that with Patterson Palmer in Nova Scotia. Mr. Amos submitted that he

> had a number of disputes with Patterson Palmer and Patterson Law and

> therefore Justice Webb has a conflict simply because he was a partner

> of these firms. Mr. Amos is not alleging that Justice Webb was

> personally involved in or had any knowledge of any matter in which Mr.

> Amos was involved with Justice Webb’s former law firm – only that he

> was a member of such firm.

>

>

> [14] During his oral submissions at the hearing of his

> appeal Mr. Amos, in relation to the alleged conflict for Justice Webb,

> focused on dealings between himself and a particular lawyer at

> Patterson Law. However, none of the documents submitted by Mr. Amos at

> the hearing or subsequently related to any dealings with this

> particular lawyer nor is it clear when Mr. Amos was dealing with this

> lawyer. In particular, it is far from clear whether such dealings were

> after the time that Justice Webb was appointed as a Judge of the Tax

> Court of Canada over 10 years ago.

>

>

> [15] The documents that he submitted in relation to the

> alleged conflict for Justice Webb largely relate to dealings between

> Byron Prior and the St. John’s Newfoundland and Labrador office of

> Patterson Palmer, which is not in the same province where Justice Webb

> practiced law. The only document that indicates any dealing between

> Mr. Amos and Patterson Palmer is a copy of an affidavit of Stephen May

> who was a partner in the St. John’s NL office of Patterson Palmer. The

> affidavit is dated January 24, 2005 and refers to a number of e-mails

> that were sent by Mr. Amos to Stephen May. Mr. Amos also included a

> letter that is addressed to four individuals, one of whom is John

> Crosbie who was counsel to the St. John’s NL office of Patterson

> Palmer. The letter is dated September 2, 2004 and is addressed to

> “John Crosbie, c/o Greg G. Byrne, Suite 502, 570 Queen Street,

> Fredericton, NB E3B 5E3”. In this letter Mr. Amos alludes to a

> possible lawsuit against Patterson Palmer.

> [16] Mr. Amos’ position is that simply because Justice Webb

> was a lawyer with Patterson Palmer, he now has a conflict. In Wewaykum

> Indian Band v. Her Majesty the Queen, 2003 SCC 45, [2003] 2 S.C.R.

> 259, the Supreme Court of Canada noted that disqualification of a

> judge is to be determined based on whether there is a reasonable

> apprehension of bias:

> 60 In Canadian law, one standard has now emerged as the

> criterion for disqualification. The criterion, as expressed by de

> Grandpré J. in Committee for Justice and Liberty v. National Energy

> Board, …[[1978] 1 S.C.R. 369, 68 D.L.R. (3d) 716], at p. 394, is the

> reasonable apprehension of bias:

> … the apprehension of bias must be a reasonable one, held by

> reasonable and right minded persons, applying themselves to the

> question and obtaining thereon the required information. In the words

> of the Court of Appeal, that test is "what would an informed person,

> viewing the matter realistically and practically -- and having thought

> the matter through -- conclude. Would he think that it is more likely

> than not that [the decision-maker], whether consciously or

> unconsciously, would not decide fairly."

>

> [17] The issue to be determined is whether an informed

> person, viewing the matter realistically and practically, and having

> thought the matter through, would conclude that Mr. Amos’ allegations

> give rise to a reasonable apprehension of bias. As this Court has

> previously remarked, “there is a strong presumption that judges will

> administer justice impartially” and this presumption will not be

> rebutted in the absence of “convincing evidence” of bias (Collins v.

> Canada, 2011 FCA 140 at para. 7, [2011] 4 C.T.C. 157 [Collins]. See

> also R. v. S. (R.D.), [1997] 3 S.C.R. 484 at para. 32, 151 D.L.R.

> (4th) 193).

>

> [18] The Ontario Court of Appeal in Rando Drugs Ltd. v.

> Scott, 2007 ONCA 553, 86 O.R. (3d) 653 (leave to appeal to the Supreme

> Court of Canada refused, 32285 (August 1, 2007)), addressed the

> particular issue of whether a judge is disqualified from hearing a

> case simply because he had been a member of a law firm that was

> involved in the litigation that was now before that judge. The Ontario

> Court of Appeal determined that the judge was not disqualified if the

> judge had no involvement with the person or the matter when he was a

> lawyer. The Ontario Court of Appeal also explained that the rules for

> determining whether a judge is disqualified are different from the

> rules to determine whether a lawyer has a conflict:

> 27 Thus, disqualification is not the natural corollary to a

> finding that a trial judge has had some involvement in a case over

> which he or she is now presiding. Where the judge had no involvement,

> as here, it cannot be said that the judge is disqualified.

>

>

> 28 The point can rightly be made that had Mr. Patterson been

> asked to represent the appellant as counsel before his appointment to

> the bench, the conflict rules would likely have prevented him from

> taking the case because his firm had formerly represented one of the

> defendants in the case. Thus, it is argued how is it that as a trial

> judge Patterson J. can hear the case? This issue was considered by the

> Court of Appeal (Civil Division) in Locabail (U.K.) Ltd. v. Bayfield

> Properties Ltd., [2000] Q.B. 451. The court held, at para. 58, that

> there is no inflexible rule governing the disqualification of a judge

> and that, "[e]verything depends on the circumstances."

>

>

> 29 It seems to me that what appears at first sight to be an

> inconsistency in application of rules can be explained by the

> different contexts and in particular, the strong presumption of

> judicial impartiality that applies in the context of disqualification

> of a judge. There is no such presumption in cases of allegations of

> conflict of interest against a lawyer because of a firm's previous

> involvement in the case. To the contrary, as explained by Sopinka J.

> in MacDonald Estate v. Martin (1990), 77 D.L.R. (4th) 249 (S.C.C.),

> for sound policy reasons there is a presumption of a disqualifying

> interest that can rarely be overcome. In particular, a conclusory

> statement from the lawyer that he or she had no confidential

> information about the case will never be sufficient. The case is the

> opposite where the allegation of bias is made against a trial judge.

> His or her statement that he or she knew nothing about the case and

> had no involvement in it will ordinarily be accepted at face value

> unless there is good reason to doubt it: see Locabail, at para. 19.

>

>

> 30 That brings me then to consider the particular circumstances

> of this case and whether there are serious grounds to find a

> disqualifying conflict of interest in this case. In my view, there are

> two significant factors that justify the trial judge's decision not to

> recuse himself. The first is his statement, which all parties accept,

> that he knew nothing of the case when it was in his former firm and

> that he had nothing to do with it. The second is the long passage of

> time. As was said in Wewaykum, at para. 85:

> To us, one significant factor stands out, and must inform

> the perspective of the reasonable person assessing the impact of this

> involvement on Binnie J.'s impartiality in the appeals. That factor is

> the passage of time. Most arguments for disqualification rest on

> circumstances that are either contemporaneous to the decision-making,

> or that occurred within a short time prior to the decision-making.

> 31 There are other factors that inform the issue. The Wilson

> Walker firm no longer acted for any of the parties by the time of

> trial. More importantly, at the time of the motion, Patterson J. had

> been a judge for six years and thus had not had a relationship with

> his former firm for a considerable period of time.

>

>

> 32 In my view, a reasonable person, viewing the matter

> realistically would conclude that the trial judge could deal fairly

> and impartially with this case. I take this view principally because

> of the long passage of time and the trial judge's lack of involvement

> in or knowledge of the case when the Wilson Walker firm had carriage.

> In these circumstances it cannot be reasonably contended that the

> trial judge could not remain impartial in the case. The mere fact that

> his name appears on the letterhead of some correspondence from over a

> decade ago would not lead a reasonable person to believe that he would

> either consciously or unconsciously favour his former firm's former

> client. It is simply not realistic to think that a judge would throw

> off his mantle of impartiality, ignore his oath of office and favour a

> client - about whom he knew nothing - of a firm that he left six years

> earlier and that no longer acts for the client, in a case involving

> events from over a decade ago.

> (emphasis added)

>

> [19] Justice Webb had no involvement with any matter

> involving Mr. Amos while he was a member of Patterson Palmer or

> Patterson Law, nor does Mr. Amos suggest that he did. Mr. Amos made it

> clear during the hearing of this matter that the only reason for the

> alleged conflict for Justice Webb was that he was a member of

> Patterson Law and Patterson Palmer. This is simply not enough for

> Justice Webb to be disqualified. Any involvement of Mr. Amos with

> Patterson Law while Justice Webb was a member of that firm would have

> had to occur over 10 years ago and even longer for the time when he

> was a member of Patterson Palmer. In addition to the lack of any

> involvement on his part with any matter or dispute that Mr. Amos had

> with Patterson Law or Patterson Palmer (which in and of itself is

> sufficient to dispose of this matter), the length of time since

> Justice Webb was a member of Patterson Law or Patterson Palmer would

> also result in the same finding – that there is no conflict in Justice

> Webb hearing this appeal.

>

> [20] Similarly in R. v. Bagot, 2000 MBCA 30, 145 Man. R.

> (2d) 260, the Manitoba Court of Appeal found that there was no

> reasonable apprehension of bias when a judge, who had been a member of

> the law firm that had been retained by the accused, had no involvement

> with the accused while he was a lawyer with that firm.

>

> [21] In Del Zotto v. Minister of National Revenue, [2000] 4

> F.C. 321, 257 N.R. 96, this court did find that there would be a

> reasonable apprehension of bias where a judge, who while he was a

> lawyer, had recorded time on a matter involving the same person who

> was before that judge. However, this case can be distinguished as

> Justice Webb did not have any time recorded on any files involving Mr.

> Amos while he was a lawyer with Patterson Palmer or Patterson Law.

>

> [22] Mr. Amos also included with his submissions a CD. He

> stated in his affidavit dated June 26, 2017 that there is a “true copy

> of an American police surveillance wiretap entitled 139” on this CD.

> He has also indicated that he has “provided a true copy of the CD

> entitled 139 to many American and Canadian law enforcement authorities

> and not one of the police forces or officers of the court are willing

> to investigate it”. Since he has indicated that this is an “American

> police surveillance wiretap”, this is a matter for the American law

> enforcement authorities and cannot create, as Mr. Amos suggests, a

> conflict of interest for any judge to whom he provides a copy.

>

> [23] As a result, there is no conflict or reasonable

> apprehension of bias for Justice Webb and therefore, no reason for him

> to recuse himself.

>

> [24] Mr. Amos alleged that Justice Near’s past professional

> experience with the government created a “quasi-conflict” in deciding

> the cross-appeal. Mr. Amos provided no details and Justice Near

> confirmed that he had no prior knowledge of the matters alleged in the

> Claim. Justice Near sees no reason to recuse himself.

>

> [25] Insofar as it is possible to glean the basis for Mr.

> Amos’ allegations against Justice Gleason, it appears that he alleges

> that she is incapable of hearing this appeal because he says he wrote

> a letter to Brian Mulroney and Jean Chrétien in 2004. At that time,

> both Justice Gleason and Mr. Mulroney were partners in the law firm

> Ogilvy Renault, LLP. The letter in question, which is rude and angry,

> begins with “Hey you two Evil Old Smiling Bastards” and “Re: me suing

> you and your little dogs too”. There is no indication that the letter

> was ever responded to or that a law suit was ever commenced by Mr.

> Amos against Mr. Mulroney. In the circumstances, there is no reason

> for Justice Gleason to recuse herself as the letter in question does

> not give rise to a reasonable apprehension of bias.

>

>

> III. Issue

>

> [26] The issue on the cross-appeal is as follows: Did the

> Judge err in setting aside the Prothonotary’s Order striking the Claim

> in its entirety without leave to amend and in determining that Mr.

> Amos’ allegation that the RCMP barred him from the New Brunswick

> legislature in 2004 was capable of supporting a cause of action?

>

> IV. Analysis

>

> A. Standard of Review

>

> [27] Following the Judge’s decision to set aside the

> Prothonotary’s Order, this Court revisited the standard of review to

> be applied to discretionary decisions of prothonotaries and decisions

> made by judges on appeals of prothonotaries’ decisions in Hospira

> Healthcare Corp. v. Kennedy Institute of Rheumatology, 2016 FCA 215,

> 402 D.L.R. (4th) 497 [Hospira]. In Hospira, a five-member panel of

> this Court replaced the Aqua-Gem standard of review with that

> articulated in Housen v. Nikolaisen, 2002 SCC 33, [2002] 2 S.C.R. 235

> [Housen]. As a result, it is no longer appropriate for the Federal

> Court to conduct a de novo review of a discretionary order made by a

> prothonotary in regard to questions vital to the final issue of the

> case. Rather, a Federal Court judge can only intervene on appeal if

> the prothonotary made an error of law or a palpable and overriding

> error in determining a question of fact or question of mixed fact and

> law (Hospira at para. 79). Further, this Court can only interfere with

> a Federal Court judge’s review of a prothonotary’s discretionary order

> if the judge made an error of law or palpable and overriding error in

> determining a question of fact or question of mixed fact and law

> (Hospira at paras. 82-83).

>

> [28] In the case at bar, the Judge substituted his own

> assessment of Mr. Amos’ Claim for that of the Prothonotary. This Court

> must look to the Prothonotary’s Order to determine whether the Judge

> erred in law or made a palpable and overriding error in choosing to

> interfere.

>

>

> B. Did the Judge err in interfering with the

> Prothonotary’s Order?

>

> [29] The Prothontoary’s Order accepted the following

> paragraphs from the Crown’s submissions as the basis for striking the

> Claim in its entirety without leave to amend:

>

> 17. Within the 96 paragraph Statement of Claim, the Plaintiff

> addresses his complaint in paragraphs 14-24, inclusive. All but four

> of those paragraphs are dedicated to an incident that occurred in 2006

> in and around the legislature in New Brunswick. The jurisdiction of

> the Federal Court does not extend to Her Majesty the Queen in right of

> the Provinces. In any event, the Plaintiff hasn’t named the Province

> or provincial actors as parties to this action. The incident alleged

> does not give rise to a justiciable cause of action in this Court.

> (…)

>

>

> 21. The few paragraphs that directly address the Defendant

> provide no details as to the individuals involved or the location of

> the alleged incidents or other details sufficient to allow the

> Defendant to respond. As a result, it is difficult or impossible to

> determine the causes of action the Plaintiff is attempting to advance.

> A generous reading of the Statement of Claim allows the Defendant to

> only speculate as to the true and/or intended cause of action. At

> best, the Plaintiff’s action may possibly be summarized as: he

> suspects he is barred from the House of Commons.

> [footnotes omitted].

>

>

> [30] The Judge determined that he could not strike the Claim

> on the same jurisdictional basis as the Prothonotary. The Judge noted

> that the Federal Court has jurisdiction over claims based on the

> liability of Federal Crown servants like the RCMP and that the actors

> who barred Mr. Amos from the New Brunswick legislature in 2004

> included the RCMP (Federal Court Judgment at para. 23). In considering

> the viability of these allegations de novo, the Judge identified

> paragraph 14 of the Claim as containing “some precision” as it

> identifies the date of the event and a RCMP officer acting as

> Aide-de-Camp to the Lieutenant Governor (Federal Court Judgment at

> para. 27).

>

>

> [31] The Judge noted that the 2004 event could support a

> cause of action in the tort of misfeasance in public office and

> identified the elements of the tort as excerpted from Meigs v. Canada,

> 2013 FC 389, 431 F.T.R. 111:

>

>

> [13] As in both the cases of Odhavji Estate v Woodhouse, 2003 SCC

> 69 [Odhavji] and Lewis v Canada, 2012 FC 1514 [Lewis], I must

> determine whether the plaintiffs’ statement of claim pleads each

> element of the alleged tort of misfeasance in public office:

>

> a) The public officer must have engaged in deliberate and unlawful

> conduct in his or her capacity as public officer;

>

> b) The public officer must have been aware both that his or her

> conduct was unlawful and that it was likely to harm the plaintiff; and

>

> c) There must be an element of bad faith or dishonesty by the public

> officer and knowledge of harm alone is insufficient to conclude that a

> public officer acted in bad faith or dishonestly.

> Odhavji, above, at paras 23, 24 and 28

> (Federal Court Judgment at para. 28).

>

> [32] The Judge determined that Mr. Amos disclosed sufficient

> material facts to meet the elements of the tort of misfeasance in

> public office because the actors, who barred him from the New

> Brunswick legislature in 2004, including the RCMP, did so for

> “political reasons” (Federal Court Judgment at para. 29).

>

> [33] This Court’s discussion of the sufficiency of pleadings

> in Merchant Law Group v. Canada (Revenue Agency), 2010 FCA 184, 321

> D.L.R (4th) 301 is particularly apt:

>

> …When pleading bad faith or abuse of power, it is not enough to

> assert, baldly, conclusory phrases such as “deliberately or

> negligently,” “callous disregard,” or “by fraud and theft did steal”.

> “The bare assertion of a conclusion upon which the court is called

> upon to pronounce is not an allegation of material fact”. Making bald,

> conclusory allegations without any evidentiary foundation is an abuse

> of process…

>

> To this, I would add that the tort of misfeasance in public office

> requires a particular state of mind of a public officer in carrying

> out the impunged action, i.e., deliberate conduct which the public

> officer knows to be inconsistent with the obligations of his or her

> office. For this tort, particularization of the allegations is

> mandatory. Rule 181 specifically requires particularization of

> allegations of “breach of trust,” “wilful default,” “state of mind of

> a person,” “malice” or “fraudulent intention.”

> (at paras. 34-35, citations omitted).

>

> [34] Applying the Housen standard of review to the

> Prothonotary’s Order, we are of the view that the Judge interfered

> absent a legal or palpable and overriding error.

>

> [35] The Prothonotary determined that Mr. Amos’ Claim

> disclosed no reasonable claim and was fundamentally vexatious on the

> basis of jurisdictional concerns and the absence of material facts to

> ground a cause of action. Paragraph 14 of the Claim, which addresses

> the 2004 event, pleads no material facts as to how the RCMP officer

> engaged in deliberate and unlawful conduct, knew that his or her

> conduct was unlawful and likely to harm Mr. Amos, and acted in bad

> faith. While the Claim alleges elsewhere that Mr. Amos was barred from

> the New Brunswick legislature for political and/or malicious reasons,

> these allegations are not particularized and are directed against

> non-federal actors, such as the Sergeant-at-Arms of the Legislative

> Assembly of New Brunswick and the Fredericton Police Force. As such,

> the Judge erred in determining that Mr. Amos’ allegation that the RCMP

> barred him from the New Brunswick legislature in 2004 was capable of

> supporting a cause of action.

>

> [36] In our view, the Claim is made up entirely of bare

> allegations, devoid of any detail, such that it discloses no

> reasonable cause of action within the jurisdiction of the Federal

> Courts. Therefore, the Judge erred in interfering to set aside the

> Prothonotary’s Order striking the claim in its entirety. Further, we

> find that the Prothonotary made no error in denying leave to amend.

> The deficiencies in Mr. Amos’ pleadings are so extensive such that

> amendment could not cure them (see Collins at para. 26).

>

> V. Conclusion

> [37] For the foregoing reasons, we would allow the Crown’s

> cross-appeal, with costs, setting aside the Federal Court Judgment,

> dated January 25, 2016 and restoring the Prothonotary’s Order, dated

> November 12, 2015, which struck Mr. Amos’ Claim in its entirety

> without leave to amend.

> "Wyman W. Webb"

> J.A.

> "David G. Near"

> J.A.

> "Mary J.L. Gleason"

> J.A.

>

>

>

> FEDERAL COURT OF APPEAL

> NAMES OF COUNSEL AND SOLICITORS OF RECORD

>

> A CROSS-APPEAL FROM AN ORDER OF THE HONOURABLE JUSTICE SOUTHCOTT DATED

> JANUARY 25, 2016; DOCKET NUMBER T-1557-15.

> DOCKET:

>

> A-48-16

>

>

>

> STYLE OF CAUSE:

>

> DAVID RAYMOND AMOS v. HER MAJESTY THE QUEEN

>

>

>

> PLACE OF HEARING:

>

> Fredericton,

> New Brunswick

>

> DATE OF HEARING:

>

> May 24, 2017

>

> REASONS FOR JUDGMENT OF THE COURT BY:

>

> WEBB J.A.

> NEAR J.A.

> GLEASON J.A.

>

> DATED:

>

> October 30, 2017

>

> APPEARANCES:

> David Raymond Amos

>

>

> For The Appellant / respondent on cross-appeal

> (on his own behalf)

>

> Jan Jensen

>

>

> For The Respondent / appELLANT ON CROSS-APPEAL

>

> SOLICITORS OF RECORD:

> Nathalie G. Drouin

> Deputy Attorney General of Canada

>