https://rumble.com/v3n00cu-the-great-canadian-relay-october-4.html

The Great Canadian Relay - October 4

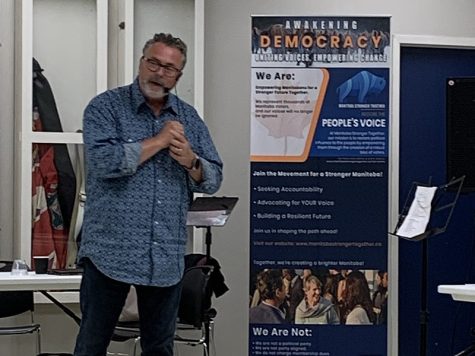

Awakening Democracy Tour

Agenda:

Meet & Greet

Oh Canada! Rosalie Drysdale

Welcome Message,

Introduction of Barbara Bendera by Rosalie Drysdale

Speaker #1: Barbera Bendera: "LIFE IN COMMUNIST CHINA A FIRST HAND ACCOUNT"

Introduction of Chris Riddell by Rosalie Drysdale

Speaker #2: Chris Riddell: "WHAT IS MST All ABOUT"

Introduction of Ken Drysdale by Barbara Bendera

Speaker #3: Ken Drysdale "DO YOU REMEMBER, THE SHELL GAME AND WHY NOT"

Invitation to Join MST: Ken Drysdale

Song "The Road Ahead": Rosalie Drysdale

Wrap Up and Social time: Ken Drysdale

Stonewall

Date: November 15, 2023

Time: 6:30 pm to 8:30 pm

Location: Anglican Church of Ascension Parochial Hall; 291 1st St W, Stonewall, Manitoba,

Map: Click Here for Map

Bring MST to Your Town!

We've been on an incredible journey with our Awakening Democracy Tour, visiting towns and cities across Manitoba, and the response has been overwhelming.

Now, we want to met you, in your community!

If you'd like to see us bring the Awakening Democracy Tour to your town, we encourage you to get in touch.

Your voice matters, and we're eager to work with communities all across Manitoba to make a difference together.

Please send your requests and suggestions to kendrysdale@manitobastrongertogether.ca.

We welcome your interest and participation and look forward to joining

forces to promote democracy and positive change in your town.

Thank you for your continued support of Manitoba Stronger Together.

Together, we can make our province stronger and more united.

Manitoba Stronger Together

Submitted by: Patty Schullman |

Summary of Manitoba Stronger Together meeting

held in Swan River Sunday, September 10 @ 2:00 – 4:00 pm

__________________________________

The meeting opened with Rosalie Drysdale leading in singing our National Anthem “ O Canada”.

There were four speakers as follows:

Speaker #1 Barbara Bendera, who spoke of her life in Communist China as a teacher. She talked about China’s social credit score system and total surveillance and control of its people. If the people don’t comply with the government’s demands, their social credit score declines and they are deprived of services or privileges. If they do something the government doesn’t like , their picture is plastered all over the place. If anyone is a real problem, they are sent to a “re-education camp”.

Speaker #2 Chris Riddell gave an overview of what Manitoba Stronger Together is all about. Go to their website to learn more and see how YOU can make a difference in your community and your province.

https://www.manitobastrongertogether.ca/

Speaker #3 Ken Drysdale, the Keynote Speaker, is one of the Commissioners for the National Citizens Inquiry which is a citizen led investigation into all things pertaining to Covid 19 and the over reach of the government’s response. There were numerous testimonies from all over Canada from Canadian doctors, ex police, funeral directors, Truckers Convoy leaders, school experts, ex media, lawyers, reporters, and specialists such as Dr Robert Malone, inventor of the MRNA technology in the Covid 19 vaccines. According to Dr Malone and people testifying, the experimental gene therapy (vaccine)pushed by Canada and government’s worldwide, was neither safe nor effective. Dr Malone says especially do not give the vaccine to children. Many testified of their injuries and deaths of loved ones. Funeral directors testified of the findings in the bodies of the vaxxed deceased. You can watch all the testimonies on their website. See: https://nationalcitizensinquiry.ca/

At the meeting, Ken talked of how “We the People” can make a difference in our province by working together forming a grassroots movement to make very needed changes and make our elected officials accountable to we the people instead of corporate interests that are not in the best interests of the people. You can read of all the important changes at their website. See: https://www.manitobastrongertogether.ca/

Speaker #4 Donnan McKenna, MLA Candidate for the Manitoba Keystone Party, for our area, is dedicated to assisting We the People in upholding the rights and freedoms of all Manitobans and provide us with the opportunity to create a stronger, united Manitoba and a government that is directly accountable to the people of our province. See more at: https://keystonepartymb.ca/This concluded the meeting of which everyone was thanked for coming and much thanks went out to the refreshment committee. A time of refreshments, visiting and conversations was well received. Overall the meeting was excellent, well presented and informative.

ValleyBiz

Box 330

Minitonas, MB R0L 1G0

Phone: 204-281-3114

https://police4freedom.ca/members/chris-riddell/

https://keystonepartymb.ca/candidates/donnan-mckenna

Donnan McKenna resides in the RM of Mountain with his wife and family.

Donnan’s 30-year career with the RCMP included provincial, national, and international experience in both front-line policing and command capacities. He is a crime reduction and family violence expert with experience dealing with government policy and system changes. His volunteer work includes several board positions and security operations.

Donnan retired from the RCMP in 2019 as the Officer in Charge of the Grande Prairie RCMP Detachment where he oversaw a 30% reduction in crime.

“The Keystone Party offers a new way forward. It is based on respect, listening, and empowering Manitobans. Keystone will put the power back in the hands of the people, where it rightfully belongs.”

Anyone ever tried to speak to the NCI spokesperson, Michelle Leduc Catlin?

David Amos<david.raymond.amos333@gmail.com> | Sat, Apr 15, 2023 at 12:14 PM |

| To: press@nationalcitizensinquiry.ca, canadacitizensinquiry@gmail.com, tucker@brownstone.org, jeffrey.a.tucker@gmail.com, rockwell@mises.org, tucker@mises.com, oig@sec.gov, Fred.Pretorius@gov.yk.ca, editor <editor@wikileaks.org>, "erin.otoole"<erin.otoole@parl.gc.ca>, "Robert. Jones"<Robert.Jones@cbc.ca>, "rob.moore"<rob.moore@parl.gc.ca>, "Ross.Wetmore"<Ross.Wetmore@gnb.ca>, "John.Williamson"<John.Williamson@parl.gc.ca>, "pierre.poilievre"<pierre.poilievre@parl.gc.ca>, "Marco.Mendicino"<Marco.Mendicino@parl.gc.ca>, "Michael.Duheme"<Michael.Duheme@rcmp-grc.gc.ca>, PABMINMAILG@cra-arc.gc.ca, hrd@bdplaw.com | |

| Cc: motomaniac333 <motomaniac333@gmail.com>, premier <premier@leg.gov.mb.ca>, premier <premier@gov.ab.ca>, pm <pm@pm.gc.ca>, "Katie.Telford"<Katie.Telford@pmo-cpm.gc.ca> | |

Friday, 14 April 2023 Citizen-led inquiry into Canada's pandemic response makes stop in Winnipeg | |

Citizen-led inquiry into Canada's pandemic response makes stop in Winnipeg

Public officials have been summoned to testify at hearings being held across the country, organizers say

"This is a unique inquiry in many ways. It is citizen run, it is citizen funded," said Michelle Leduc Catlin, a spokesperson for the National Citizens Inquiry into Canada's Response to COVID-19.

"There is no one funder. This is done through people in Canada who want to hear what Canadians have experienced."

Hearings held so far have included testimony from expert witnesses and members of the public on pandemic policies. The inquiry started in Truro, N.S., before moving to Toronto and now to Winnipeg, where the first of three days of hearings took place at the Holiday Inn Airport West Hotel on Thursday.

Witnesses questioned the decision-making and science behind public health measures such as vaccine mandates, restrictions on in-person gatherings and school closures.

National Citizens Inquiry spokesperson Michelle Leduc Catlin says the citizen-led inquiry is unique. (Randall McKenzie/CBC)

They also spoke out about concerns around allegations of media censorship of scientists and experts.

The inquiry was originally launched by former Reform Party leader Preston Manning, who organizers said has since stepped aside as spokesperson.

Four inquiry commissioners listened and asked questions of witnesses participating both remotely via video and in person.

During one exchange, commissioner Ken Drysdale asked Stanford University health policy Prof. Jay Bhattacharya whether risk assessments on implementing policies such as remote learning gave enough consideration to the consequences.

"You would think about a whole wide range of outcomes from a policy, not just simply the putative benefits of a policy before you adopt it," said Bhattacharya, a critic of lockdown measures in the U.S. and a co-author of the controversial Great Barrington Declaration. It suggested building up herd immunity by allowing the coronavirus that causes COVID-19 to spread naturally, and encouraged focused protection of people at higher risk of dying from the illness.

"I think so many of those principles were thrown aside in the decision-making around COVID and COVID policy," said Bhattacharya, who also testified as a witness during a 2021 court challenge against Manitoba's COVID-19 restrictions launched by seven Manitoba churches.

A justice with what was then Court of Queen's Bench rejected their argument that the restrictions violated the Charter of Rights and Freedoms, ruling they were necessary to prevent the spread of COVID-19.

Stefanson, Roussin summoned

The inquiry's website says public officials, including Manitoba Premier Heather Stefanson and Chief Provincial Public Health Officer Dr. Brent Roussin, were summoned to testify.

In a statement to CBC, the province said Roussin receives a number of invitations and declined this one.

Decisions on COVID-19 restrictions "were made based on the best available medical advice," the province said in an email.

Patrick Allard, a vocal opponent of Manitoba's public health measures who was fined nearly $35,000 last year for violating those measures, signed up to testify about the impact on him and his family.

Patrick Allard is a vocal opponent of public health measures who signed

up to participate in the National Citizens Inquiry. (Randall

McKenzie/CBC)

"My ticketing during COVID protests, my arrests … I'm going to be bringing that up, I'm going to be bringing up the harms that I saw with my eyes among my own family from lockdown measures," Allard said, noting he's particularly concerned about the isolation his great-grandmother experienced in a nursing home.

Rick Dyck, a People's Party of Canada riding director in Winnipeg, said he attended because he disagreed with public health measures such as mask mandates in grocery stores.

"There was a time I went to [a grocery store] on St. James, and there was an officer there and he denied me the ability to buy food just because I wasn't wearing a mask," Dyck said.

"I'm glad this inquiry is happening so that we can get some accountability and to stop this from ever happening again."

Four

inquiry commissioners listened and asked questions of witnesses who

participated both remotely via video and in person on Thursday. (Randall McKenzie/CBC)

The hearings in Winnipeg are set to wrap up Saturday evening. The inquiry next stops in Saskatoon and is scheduled to end in Ottawa May 19.

Organizers said at the end of it all, the commissioners will put together a report with recommendations and share it publicly.

62 Comments

I just called

Heather R. DiGregorio<hrd@bdplaw.com> | Sun, Apr 16, 2023 at 11:31 PM |

| To: David Amos <david.raymond.amos333@gmail.com> | |

Thank you for reaching out. The National Citizens Inquiry will be conducting hearings across the country over the next few months. If you would like to participate, then please go to our website for more information. Take care,

Heather DiGregorio From: David Amos <david.raymond.amos333@gmail.

https:// | |

https://rumble.com/v2osyxu-im-not-the-only-paramedic-vaccine-injured-chet-chisholm.html

I'm not the only Paramedic vaccine injured Chet Chisholm

Nova Scotia Free Speech Bulletin Podcast

234 followers

4 months ago

484

Tonight on the Nova Scotia Free Speech Bulletin board podcast Tony Lohnes with Chet Chisholm on his vaccine injury and his role as a volunteer for the National Citizens Inquiry.

https://nationalcitizensinquiry.ca/truro-testimony/

This page has unedited versions of the testimony from each hearing. Edited clips of each witness’s testimony are coming, with English and French transcription. Until those are ready, please use the timestamp documents provided for each hearing to find the testimony you’re looking for.

Truro, Nova Scotia – Day 1 – 16/3/2023

Ches Crosbie 0:42:33 – 0:52:10

Dr. Chris Milburn 0:52:30 – 1:35:59

Dr. Peter McCullough 1:36:55 – 2:02:45

Dr. Patrick Phillips 2:31:40 – 3:26:18

Cathy Careen 3:32:10 – 3:52:25

Shelly Hipson 4:42:50 – 5:37:30

Dr. Stephen Bate 5:39:05 – 6:01:15

Vonnie Allen 6:02:04 – 6:32:05

Leigh-Anne Coolen 6:56:20 – 7:11:05

Chet Chisholm 7:12:15 – 7:33:30

Artur Anselm 7:33:59 – 7:46:35

Kassandra Murray 7:48:07 – 8:22:40

You can watch it on Rumble here.

Here is a time stamp of the day’s testimony.

Truro, Nova Scotia – Day 2 – 17/3/2023

Ches Crosbie 0:18:57 – 0:32:02

Darrell Shelley 0:32:20 – 0:55:52

Terry Lachappelle 0:57:08 – 1:17:40

Peter Van Caulart 1:20:08 – 1:46:12

Amie Johnson 1:47:05 – 2:10:31

Kathy Howland 2:10:59 – 2:29:26

Alison Petten 2:57:16 – 3:23:02

Elizabeth Cummings 3:23:45 – 3:40:48

Dr. Joseph Fraiman 4:39:12 – 5:47:25

Paula Doiron 5:48:07 – 6:18:02

Chief Greg Burke 6:18:32 – 6:56:30

Sabrina McGrath 7:15:00 – 7:28:40

Pastor Jason McVicar 7:30:00 – 8:03:44

Bliss Behare 8:04:43 – 8:16:10

Joe Behare 8:16:38 – 8:32:49

You can watch it on Rumble here.

Here is a time stamp of the day’s testimony.

Truro, Nova Scotia – Day 3 – 18/3/2023

Dr. Laura Braden 0:7:20 – 2:17:01

Dr. Matthew Tucker 2:18:48 – 2:49:13

Dr. Aris Lavranos 2:51:42 – 3:41:03

Dr. Dion Davidson 3:53:46 – 4:45:57

Ellen Smith 5:10:20 – 5:28:09

Scott Spidle 5:28:34 – 5:48:42

Janessa Blauvelt 5:50:00 – 6:24:07

Jordan Peterson 6:24:35 – 6:32:05

Josephine Fillier 6:48:20 – 7:07:40

Linda Adshade 7:08:23 – 7:28:00

Katrina Burns 7:28:34 – 7:54:14

Kirk Desrosiers 7:54:58 – 8:20:45

Tami Clarke 8:21:27 – 8:36:08

Ches Crosbie 8:36:23 – 8:47:01