Holt says 'surprise' federal tax holiday could cost province $62M

Federal minister says government will work with provinces affected

Premier Susan Holt says the federal tax holiday on some goods announced Thursday could cost New Brunswick $62 million in revenue.

"We're trying to figure out what this means," Holt said on Information Morning Fredericton on Friday.

The development came a week after New Brunswick released an update forecasting a deficit of $92.1 million for the 2024-25 fiscal year.

Prime Minister Justin Trudeau announced a two-month tax holiday on a list of goods Thursday that would run from Dec. 14 to Feb. 15, 2025.

"That was a surprise," Holt said about the announcement made with about a day's notice.

New Brunswick is one of five provinces with a harmonized sales tax, a combination of a federal and provincial tax on goods and services. The federal government collects the revenue and sends the provincial portion to the province.

On Thursday, a spokesperson for Finance Minister Chrystia Freeland said that if the tax-break plan goes ahead, the entire HST would be removed.

Prime

Minister Justin Trudeau and Deputy Prime Minister Chrystia Freeland

visit Vince’s Market, a grocery store in Sharon, Ont., on Nov. 21. (Chris Young/Canadian Press)

Holt said the lost tax revenue can't be made up through finding "efficiencies" in the budget.

She said New Brunswick will be talking to the federal government about how it will offset the cost.

"We can't take a $62-million unexpected hit to our budget," Holt said. "So I'm optimistic that the federal government will help keep us whole."

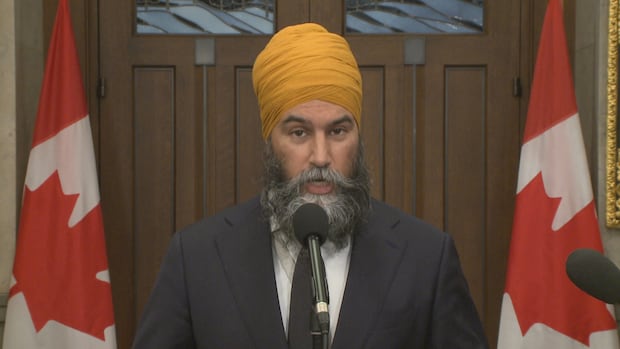

Dominic LeBlanc, the federal intergovernmental affairs and public safety minister, speaking with Radio-Canada on Friday. (Patrick Lacelle/Radio-Canada)

Dominic LeBlanc, the federal intergovernmental affairs and public safety minister, speaking with Radio-Canada on Friday. (Patrick Lacelle/Radio-Canada)

Dominic LeBlanc, the federal intergovernmental affairs minister and Beauséjour MP, told Radio-Canada's La matinale radio program on Friday that he realizes it's complicated for provincial budgets.

LeBlanc said the federal government will work with provinces on the issue.

The potential loss in tax revenue comes as a new government has pledged to implement several multimillion-dollar programs.

Retention pay for nurses is expected to cost $74 million, some of which Holt has said was already budgeted. A planned 10 per cent rebate on power bills will cost another $90 million, she said.

The tax revenue loss, and the spending promises, were raised in the legislature Friday.

"So now we have a government that's said we're going to keep all of our commitments, and we're going to balance the books," Opposition Leader Glen Savoie said. "So what is going to have to remove in order to live up to that commitment?"

He later asked if Holt would abandon the promised power rebate.

"We made a commitment to New Brunswickers and they elected our team in record numbers," Holt said in response.

With files from Information Morning Fredericton and Radio-Canada

Some provinces say they could lose millions of dollars to federal tax break

In the five provinces with an HST, the entire tax will be removed for duration of proposed federal break

A federally-imposed "tax holiday" could end up being costly for some provinces, and officials from two provincial governments said they were "blindsided" by the prime minister's announcement Thursday that the federal government is suspending the sales tax for some goods.

On Thursday, Prime Minister Justin Trudeau said he would seek to lift the GST and HST from some goods until mid-February in a bid to alleviate some of the affordability pressures people have been experiencing in the post-pandemic era.

Five Canadian provinces have a harmonized sales tax — a combination of provincial and federal taxes on goods and services administered by the federal government. Ottawa sends the provincial portion of the sales tax back to the respective provinces.

A spokesperson for Finance Minister Chrystia Freeland confirmed that if the tax break plan goes ahead, the entire HST would be removed in the provinces that harmonize the sales tax — the Atlantic provinces and Ontario.But officials from two provinces say they were given less than 24 hours' notice that the entire sales tax would be removed.

They also said it's not clear whether they'll receive any compensation from the federal government for the lost tax revenue.

Representatives of two provincial governments with HSTs spoke to CBC News on the condition that neither they nor their provinces be identified because of the sensitivity of the issue.

Responses vary by province

Newfoundland and Labrador Premier Andrew Furey endorsed the federal plan for the "tax vacation" out of the gates.

Furey, who is one of just two Liberal premiers in the country, said on the social media platform X he welcomed the proposal to remove the HST from many goods and services for two months.

New Brunswick Premier Susan Holt was more circumspect.

"We're trying to understand what it is, what it might cost," Holt said Thursday. "Is this something where we're going to be sacrificing provincial tax revenue, so it's going to be a hit on provincial revenues in this fiscal year?"

Ontario already has eliminated the provincial portion of the HST from some of the goods proposed for the federal tax vacation, including children's clothing, shoes, diapers, books and newspapers.

In a media statement, Premier Doug Ford's office said "the best thing the Liberal government can do right now is ditch, or at the very least pause, any hike in the carbon tax which is set to increase for the sixth time on April 1."

Nova Scotia is currently in an election campaign so its provincial government is in caretaker mode.Prince Edward Island did not immediately respond to a request for comment.

Trudeau government to send $250 cheques to most people, slash GST on some goods

GST/HST holiday will last from Dec. 14 to February

Prime Minister Justin Trudeau announced Thursday a suite of new measures meant to alleviate some of the affordability pressures people have been experiencing in the post-COVID era — including a two-month GST holiday on some goods and services.

The Liberal government will also send $250 cheques to the 18.7 million people in Canada who worked in 2023 and earned $150,000 or less.

Those cheques, which the government is calling the "Working Canadians Rebate," will arrive sometime in "early spring 2025," Trudeau said.

The GST/HST holiday will start on Dec. 14 and run through Feb. 15, 2025.People will be able to buy the following goods GST-free:

- Prepared foods, including vegetable trays, pre-made meals and salads, and sandwiches.

- Restaurant meals, whether dine-in, takeout or delivery.

- Snacks, including chips, candy and granola bars.

- Beer, wine, cider and pre-mixed alcoholic beverages below 7 per cent alcohol by volume (ABV).

- Children's clothing and footwear, car seats and diapers.

- Children's toys, such as board games, dolls and video game consoles.

- Books, print newspapers and puzzles for all ages.

- Christmas trees.

With these exemptions, all food in Canada will be essentially tax-free.

"For two months, Canadians are going to get a real break on everything they do," Trudeau said at a media event in Newmarket, Ont.

"Our government can't set prices at the checkout but we can put more money in peoples' pockets. That's going to give people the relief they need. People are squeezed and we're there to help."

If a family spends $2,000 on the eligible goods in the two-month period, they can expect to save about $100, according to government figures.

In provinces with the HST — where the GST is harmonized with provincial sales tax — the savings will be larger, the government said.

Provinces with the HST include Ontario, Newfoundland and Labrador, Nova Scotia, New Brunswick and Prince Edward Island.

Prime Minister Justin Trudeau visits Vince’s Market, a grocery store in Sharon, Ontario, on Nov. 21, 2024. (Chris Young/Canadian Press)

In Ontario, for example, the same $2,000 basket of eligible purchases will result in estimated savings of $260 over the two-month period, the government said.

These savings will come with a big price tag for the federal government.

The tax holiday will cost the federal treasury an estimated $1.6 billion in foregone revenue. The $250 cheques will cost about $4.68 billion, a Finance official told CBC News.The two affordability measures come as the government grapples with persistent unpopularity in the polls and after two stinging defeats in recent byelections.

The CBC's Poll Tracker suggests Trudeau's Liberals are about 17 percentage points back from the first-place Conservatives. That gap has narrowed somewhat in recent weeks.

The renewed focus on the cost of living is designed to bolster the government's support among people who have been feeling the pinch after prices on almost everything have increased in recent years due to inflation.

But there's a risk this new stimulus could juice inflation, which has only recently come down to the Bank of Canada's two per cent target.

Economists agree that unprecedented government stimulus around the world during the pandemic contributed, in part, to elevated inflation as consumers flush with cash chased scarce goods.

The Bank of Canada also has said that if Ottawa had pulled back on COVID-related stimulus earlier, inflation likely would not have been as bad as it has been.

Trudeau claimed Thursday that these measures are "not going to stimulate inflation."

Finance Minister Chrystia Freeland also downplayed inflation fears, saying the Bank of Canada's aggressive rate hikes have tamed inflation and Canada is on a more solid footing now.

"We've done the hard work we needed to do to get inflation down," Freeland said.

Asked about the fiscal implications of the multi-billion dollar injection, Trudeau said the government has the capacity to implement these measures "because Canada has one of the strongest balance sheets in the world."The federal debt has doubled over the last nine years to $1.4 trillion. The cost to service that debt is projected to be $54.1 billion in 2024-25.

When asked whether it's appropriate to slash the GST on products that could be considered luxury goods, like pricey video game consoles, Trudeau said most of the government's affordability measures to this point have been more targeted, like GST rebates for low-income people and an OAS boost for seniors. He argued it's time to give to everyone some relief.

"It's time for people to get a bit of a break," Trudeau said.

Prime

Minister Justin Trudeau and Deputy Prime Minister Chrystia Freeland

visit Vince’s Market, a grocery store in Sharon, Ontario, on Nov. 21.

The government on Thursday announced a sweeping promise to make goods

like groceries, children's clothing, Christmas trees and restaurant

meals free from GST/HST between Dec. 14 and Feb. 15. (Chris Young/Canadian Press)

Conservative Leader Pierre Poilievre said Trudeau's tax measures are "a trick" because it's only temporary relief before the government goes ahead with a permanent carbon tax hike in the spring.

He said that on Trudeau's watch, housing costs have doubled, food bank use has skyrocketed and the federal carbon tax is making it more expensive for people to heat their homes. He raised the spectre of these latest measures fanning the inflationary flames.

"That's the misery you get with massive socialist money-printing and what I'm proposing is a common sense alternative," Poilievre said, while touting his plan to scrap the carbon tax and the GST on new home sales.

"Nobody believes Justin Trudeau and Jagmeet Singh after they've impoverished our people and made life worse off."

Poilievre would not say how Conservative MPs would vote on the proposal, adding he needs to see the details.

"I don't vote for press releases and press conferences," he said. "Let's see what they put before us."

NDP to support affordability measures

Speaking to reporters after Trudeau's announcement, NDP Leader Jagmeet Singh said his party will support the affordability measures in Parliament."We want to see this bill passed as quickly as possible," Singh said. "We know middle class families need a break. We're not going to oppose getting people some help."

Toys

sit on a shelf at the Swag Sisters' Toy Store in Toronto in December

2023. The Liberals plan to introduce a two-month GST vacation on certain

items before the holiday season, including toys. (Chris Young/The Canadian Press)

Toys

sit on a shelf at the Swag Sisters' Toy Store in Toronto in December

2023. The Liberals plan to introduce a two-month GST vacation on certain

items before the holiday season, including toys. (Chris Young/The Canadian Press)

Singh said the NDP will work with the Liberals to temporarily lift the logjam in Parliament to get the bill through in a single day before then allowing an ongoing filibuster to resume.

Parliament has been paralyzed for the last six sitting weeks by a standoff over documents related to a federal green technology program plagued by scandal.

Opposition MPs passed a motion demanding the government release all internal documents related to that scheme and hand them over to the police in an unredacted form. The Liberals have so far refused. Parliament has been deadlocked as a result.

Last week, the NDP promised to go even further to improve Canadians' purchasing power if elected.

Singh said he would permanently eliminate the GST on essentials such as grocery store meals and snacks, internet and cell phone bills, diapers and children's clothing, and home heating.

This measure would deprive the government of $5 billion in tax revenues each year, the NDP estimates, and would be offset by revenues from a proposed tax on excessive corporate profits.

The NDP will support the temporary measure proposed by the Liberals, even if it is deemed insufficient.

But Singh said the party "will campaign hard on permanently scrapping the GST on daily essentials and monthly bills, like we already promised."

- Is Justin Trudeau's tax break on groceries enough? How are you cutting food costs at home? That's the first topic on Cross Country Checkup this Sunday. Leave your reply here and we may read it on the Nov. 24 show.

With files from Radio-Canada's Louis Blouin

Newfoundland and Labrador Premier Andrew Furey endorsed the federal plan for the "tax vacation" out of the gates.

Furey, who is one of just two Liberal premiers in the country, said on the social media platform X he welcomed the proposal to remove the HST from many goods and services for two months."

LeBlanc said the federal government will work with provinces on the issue."

Yea Right