https://tj.news/new-brunswick/meet-the-man-with-a-singular-mission-to-lower-nb-power-bills

Meet the man on a mission to lower NB Power bills

Randy Hatfield wants to convince the New Brunswick Energy and Utilities Board low-income people should be cut a break from 20 per cent hikes

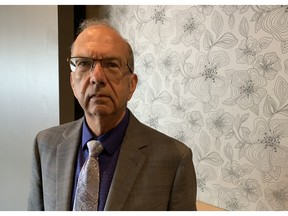

There’s one man sitting near the back of the room who’s stood out in hearings to decide if NB Power should charge the biggest electrical hike in a lifetime.

Quiet, unassuming Randy Hatfield isn’t a lawyer among the interveners. The executive director of the Human Development Council, an anti-poverty organization in Saint John, is appearing for the first time at such hearings with a singular mission: to ensure a low-income energy rebate program is created.

“People are hurting,” he told Brunswick News on Wednesday at the Fredericton Convention Centre, site of the latest hearing of the New Brunswick Energy and Utilities Board. “Despite all the Chamber of Commerce boosterism out there, I see it every day in Waterloo Village.”

Hatfield, who on most days works in Saint John’s vulnerable neighbourhood near the city centre, is deeply concerned that if NB Power successfully convinces the independent board to boost rates this year and next for a combined near-20 per cent increase, poor people will be devastated.

We need to know where we have to put pressure.

Randy Hatfield

He’s hoping the three-member board will take an unprecedented step, such as ordering NB Power to create a comprehensive energy poverty strategy, including a low-income rebate program, the kind of discount offered in other places.

According to the council’s research, more than one in three New Brunswickers – 36.3 per cent – are considered energy poor, paying more than six per cent of their after-tax income to light and heat their homes. That’s nearly twice the national average of 18.4 per cent and the highest figure of any province.

“We need to know where we have to put pressure,” Hatfield said. “NB Power is saying, ‘we lack the authority to introduce something like a low-income rebate. Go to the province.’ But I’m not sure that’s the case, and I don’t think it’s ever been argued before the board. Or if it has, it was a long time ago. And I think that needs to be revisited.”

As part of a tag team effort, on Thursday at the hearing, Shelley Petit, the chair of the New Brunswick Coalition of Persons with Disabilities, appeared virtually to ask questions of a panel of NB Power officials that included a rate design specialist and manager of customer care.

We’re paying for the mismanagement of the last 10 decades.

Shelley Petit

She told the panel that she’d done an informal survey of 50 people she knows with disabilities, and the average was paying nearly a quarter of their after-tax income on electricity, an astonishing amount.

The proposed residential rate hike this year of 9.8 per cent and a further 9.8 per cent jump next year are unaffordable, she argued.

“We’re paying for the mismanagement of the last 10 decades,” she said of the public utility.

Shelley Petit, the chair of the New Brunswick Coalition of Persons with Disabilities, says NB Power needs to do more to ensure people on low incomes are not disconnected.Photo by John Chilibeck/ Brunswick News

Later in the session, Hatfield questioned the same panel in person, asking why NB Power hadn’t created any affordability policies specifically to help low-income customers, many of whom are in arrears on their bills and worried about being disconnected.

Veronique Stevenson, a rate design specialist with NB Power, pointed out that if poorer customers were cut a special break, others would have to pay for their electricity.

“It would put the burden on other customers,” she said. “They may be paying their bills on time, but that doesn’t mean they’re not struggling.”

The number of customers who were in arrears – missing at least one monthly bill payment – peaked the year before the pandemic. In the 2018-2019 fiscal year, more than 59,000 residential customers, or 18 per cent of the total, were late paying their bills.

The numbers went down during the COVID-19 crisis, likely because rates were frozen and people who weren’t working had their incomes supplemented by Ottawa.

But the numbers have been steadily going up. In the 2022-2023 fiscal year, close to 45,000 residential customers were behind on bill payments, about 13 per cent.

The average unpaid bill for each customer was $254.77.

Likewise, customers being disconnected also went down during the pandemic because NB Power decided to be less strict when there was so much illness going around and job losses. In the year before the pandemic, 4,611 were disconnected.

In 2021, the number of disconnects was just 746. Last year, it had crept back up to 3,580.

Hatfield said it was proof that NB Power could change its policies to meet social goals.

Christina Schneider, the utility’s manager of customer care, emphasized that her staff of 15 responsible for late collections had been trained to be considerate and caring. Customers with late bills are encouraged to go on a three-month repayment plan, which can be extended to six months or even longer, if circumstances are dire.

“Caring for our customers is something my team hangs their hat on,” Schneider said.

Hatfield said he appreciated the sentiment, but wondered why NB Power hadn’t created rules around affordability and the ability for customers to pay for electricity.

Stephenson replied that such proposed changes had to be made at the highest levels of NB Power or the provincial government.

“This is a taxpayer versus ratepayer question,” she said. “It’s really more of a policy question I can’t answer.”

As part of its evidence, the Human Development Council hopes to present two of its researchers before the hearing that could serve on a panel, the same way NB Power officials and other energy experts have appeared.

Lawyers representing various interests question these experts for hours. The chief interrogators have been lawyers for the big, energy-intensive timber firm J.D. Irving, Limited, the group of municipal energy utilities such as Saint John Energy, the public intervener and the board itself.

Researchers Liam Fisher and Heather Atcheson will likely appear at the hearings in August, their day in the sun to counter the gloom over high power bills.

One difficulty would be to figure out who would pay for such a low-energy rebate program.

NB Power is a cost-of-service utility and tries to recover most of its money from its more than 400,000 customers.

Short of the provincial government intervening with taxpayer funds, offering such a program would mean the rest of NB Power customers, both commercial and residential, would have to pay more.

Higgs suggests N.B.’s SMRs may not win race to commercialization

In addressing his government’s $20-million bet on the industry, Higgs says province couldn’t just sit on the sidelines

Premier Blaine Higgs suggests that New Brunswick’s two small modular reactor companies might not be the ones that successfully prevail amid a race to commercialize.

But in addressing his government’s $20-million bet on the industry, Higgs contends that New Brunswick couldn’t just sit on the sidelines and needed to do its part in a global race toward cleaner energy.

That said, it means the province must continue to look at all other options to meet its electricity needs, according to the premier.

In an interview with Brunswick News, Higgs was questioned on the sudden departure of ARC Clean Technology Canada’s president and CEO amid layoffs made by what is one the of two SMR companies enticed to set up in New Brunswick.

It’s a company the Higgs government gave $20 million now three years ago to help develop its prospective technology, after the previous Liberal Gallant government gave it $10 million.

Last October, the federal government also awarded ARC another $7 million.

“I haven’t got any assurances one way or the other on whether they keep going or whether they’re not,” Higgs said. “As far as I’m aware, their program continues.

“The changes they’ve made, we’re seeing that in many different companies.”

He added: “I’ll remain optimistic until I know otherwise, but I don’t want to take away from the fact that we have to be prepared to look at all aspects of technology that is being presented to us.”

Higgs made reference to “some pull back” in the race towards electric car and battery manufacturing as a parallel, where some leaders have emerged.

He then referenced how the race to commercialize small modular nuclear technology now includes companies and countries around the world.

He suggested that the race is still on.

“I don’t rule any of the current ones that we have right now as being out of the game, but are there more players in the game? Yes. And do we need to understand the best one? We certainly do,” Higgs said.

As ARC rationalizes its workforce, some of its competitors are hiring.

American manufacturing company Westinghouse has opened a new engineering hub in Kitchener, Ont., that aims to support both Canadian-based and international nuclear power projects with a new 13,000-square-foot office and plans to hire 100 engineers to staff it by next year.

That’s as a partnership between Ontario Power Generation and GE-Hitachi to build a small modular reactor at Ontario’s Darlington nuclear station is closer to maturity than similar plans in New Brunswick.

At a New Brunswick Energy and Utilities Board hearing last month into a recent power rate hike, NB Power vice president Brad Coady testified he doesn’t expect the province-backed SMRs will be ready by an original target date of 2030.

The utility now believes they’ll be ready by 2032 or 2033.

But SMRs are still part of the plan.

“Our integrated resource plan says we need small modular reactors on our system by the early 2030s and we’re still confident that we can have those,” NB Power CEO Lori Clark told reporters at the hearings.

Asked if his government has now wasted $20 million in taxpayer money, Higgs disagreed, instead stating the province’s efforts are part of a larger goal.

“We know a lot of money has been spent to convert to cleaner forms of energy in the world and research and development is a big component of what is the next best thing, and so we can’t just sit by and wait,” Higgs said.

“We have to be participants in developing the technology or working with others to do so.

“Here in New Brunswick, we’re doing our part for the next generation of clean energy, and part of that is research and development. We can’t just stand by and say ‘I hope somebody figures it out.’”

Higgs defends Lepreau, but also vows not to shut coal plant if needed

'We are not going to put ourselves in jeopardy, turn the lights out, because we have a magic 2030 date': Higgs

Premier Blaine Higgs is defending the reliability of Point Lepreau, stating he isn’t worried about its longevity amid its latest problems.

But Higgs is also saying that the province’s only coal-burning plant is not going to shut down by the federal deadline if there are any concerns about the reliability of electricity in New Brunswick.

“We are not going to put ourselves in jeopardy, turn the lights out, because we have a magic 2030 date,” Higgs said in an interview with Brunswick News.

The Point Lepreau Nuclear Generating Station, which provides about one third of New Brunswick’s electricity, potentially faces a prolonged outage after problems with its generator were recently detected.

That’s after it completed a scheduled 100-day offline retooling.

It has NB Power relying more on its coal-fired plant in Belledune, as well as other parts of its generation fleet.

That’s while the feds have mandated the phase out of coal-fired electricity by 2030.

Question marks surrounding Point Lepreau’s reliability have persisted in the aftermath of a multibillion-dollar refurbishment that was completed in 2012.

According to NB Power’s own documents, among nuclear peers, Lepreau’s performance is consistently near the bottom. While most Candu reactors around the world operate close to 90 per cent of the time, Lepreau’s average over the last five years has been 78 per cent.

Extended and unplanned outages at Lepreau and Bayside generating stations cost the utility $295 million in fiscal 2022-23.

Meanwhile, a New Brunswick Energy and Utilities Board hearing last month into the utility’s double-digit rate hike request revealed that Lepreau has suffered breakdowns averaging over 19 days per year over a five-year period.

And the utility is now budgeting for 29 days of breakdowns at Lepreau per year.

But Higgs said that work to keep Lepreau online longer is working.

“In the last six months (ahead of a scheduled shut down), we have seen Point Lepreau operate better than it has for many, many months,” he said.

The premier pointed to a three-year, $2-million contract NB Power signed with Ontario Power Generation that has three employees from the Ontario utility working at Lepreau helping to improve performance.

The utility has also committed to more proactive maintenance.

NB Power did say earlier this year that Lepreau was on track to operate at 88 per cent capacity in the fiscal year that ended in March.

A 2023-24 annual report is yet to be released.

“I’m pretty optimistic on how well Point Lepreau can run,” Higgs said.

But the premier then said that the reliability of electricity is a concern regardless.

Higgs pointed to a cold snap last February where New Brunswick was running its entire generation fleet, except for wind power tied into the grid as it was too cold for them to operate.

It saw the province reach an all-time winter peak demand of just over 3,400 MW.

“As we look for cleaner, greener energy, we always have to retain reliability,” Higgs said. “People expect that.

“While we’re targeting 2030, we’re not going to be shutting the lights off to make that happen.”

The federal Liberals have been unwavering about that date.

Earlier this year, the Trudeau government announced it would spend $2 million towards a feasibility study aimed at converting the Belledune coal-fired power plant to “sustainably-sourced biomass.”

Those efforts continue, Higgs said, believing that could also provide a stable source of power.

That said, the premier said that affordability remains a factor.

Asked if he’s talked with Conservative Leader Pierre Poilievre about energy policy under a prospective Conservative federal government, Higgs said “a lot would change.”

Belledune, the Coleson Cove Generating Station, part of the utility’s fleet to be used as a winter-peaking station fuelled primarily with heavy fuel oil, and Bayside, a natural gas burning plant, are all subject to federal carbon tax, increasing the cost of electricity on the utility.

Higgs didn’t say whether Poilievre would do away with the 2030 coal phase out date, but instead noted that small modular reactor technology likely won’t be ready in that time frame to offer another option.

A request to clarify the federal party’s position was not immediately returned.

The premier said, regardless of the government in Ottawa, he won’t make changes that could impact reliability.

“Will we be ready to shut current assets down by 2030? I think it’s probably unlikely,” Higgs said.

NB Power faces record summer demand for electricity amid new problems

With Point Lepreau facing prolonged outage, utility says it’s relying more on coal-fired Belledune, other parts of generation fleet

NB Power says it’s facing record demand for power this summer, just as one of its cheapest sources of electricity remains down with new issues.

With the Point Lepreau Nuclear Generating Station facing a prolonged outage, the utility says it’s relying more on its coal-fired plant in Belledune, as well as other parts of its generation fleet.

“NB Power is forecasting record peak demand for our summer season,” said NB Power spokesperson Dominique Couture.

The reason is several fold.

The utility is citing record immigration that has swelled the province’s population, and in turn the number of users, but also a push to see New Brunswickers switch away from more carbon-intensive ways to heat their home, like heating oil, in favour of electric heat pumps – which also provide air conditioning.

That’s amid heat waves that have already hit this summer.

“New Brunswick’s population continues to grow at rates we have not seen in decades, and based on this growth and the increased penetration of heat pumps,” Couture said.

The utility has historically needed roughly 1,500 megawatts to meet the needs of customers on a typical summer morning.

It hit a summer peak load of 1,582 MW in 2021, according to the utility.

That peak grew to 1,719 MW in 2022 and 1,739 MW in 2023.

But just last month, NB Power hit a record peak summer demand of 1,760 MW during a heat wave that set temperature records across New Brunswick. It was the first of the hot weather this year.

The demand is nowhere near the province’s all-time winter peak demand of just over 3,400 MW last year.

But the summer difference is enough to prompt the utility to switch on generating capacity it typically wouldn’t this time of year.

And that’s as Lepreau, which provides about one third of New Brunswick’s electricity, potentially faces a prolonged outage after problems with its generator were detected.

“To reliably serve customer demand while the Point Lepreau Nuclear Generating Station is undergoing its maintenance outage, we are optimizing our generation fleet by relying on other units, including Belledune, Bayside, Coleson Cove and Mactaquac, which is performing well due to high flows over the past several weeks,” Couture said.

“We are also utilizing interconnections with neighboring provinces and the U.S. whenever it is economically appropriate.”

The added cost of that is unclear.

NB Power’s latest annual report makes it clear that the “effective operation of Point Lepreau Nuclear Generating Station is essential for NB Power’s positive financial performance.

“When nuclear generation is below planned levels, other more expensive fuels are used, increasing the cost of generation or purchased power costs,” reads the report.

Extended and unplanned outages at Point Lepreau and Bayside generating stations cost the utility $295 million last year.

That was as Lepreau operated at 56.6 per cent capacity.

In the current year, it has already undergone a 100-day planned outage that could get extended amid new problems.

Without Lepreau, the demand for capacity also sees NB Power rely on larger emitting sources of generation.

Federal rules call for the use of coal at Belledune to be phased out by 2030.

The Coleson Cove Generating Station, part of the utility’s fleet to be used as a winter-peaking station, is fuelled primarily with heavy fuel oil.

Meanwhile, Bayside is a natural gas burning plant.

All three stations are subject to the federal carbon tax, increasing the cost of electricity on the utility.

NB Power maintains the added costs are ongoing.

“The cost of replacement power is subject to fluctuations in market conditions and output of our generation fleet,” Couture said. “These costs are monitored and will be reported in our quarterly financial reports.”

NB Power's problem isn't about price, it's about public trust: prof

Despite the utility's claim that it needs to refurbish big power plants to ensure enough baseload power, academic says public is unconvinced

NB Power says it has a peak load problem.

The public utility is worried what will happen if electrical demand keeps going up – thanks to the province’s newfound population growth and the increasing popularity of e-vehicles – and it suddenly runs out of power to serve everyone, just when they need electricity the most.

The peak power demands in the province have always been in January and February, when thermometers dip. Three out of every four New Brunswick households primarily use electricity to heat their homes, and nine of 10 use electric hot water heaters, according to NB Power’s filings with the Energy and Utilities Board.

Despite the utility’s efforts to convince people to use heat pumps to save energy, the devices are the least efficient when it’s coldest, rendering them hardly more efficient than the traditional, wasteful electric baseboard heaters that are so commonplace.

It was these issues that Darren Clark, a senior manager of integrated resource planning at NB Power, was trying to spell out Wednesday to Glenn Zacher, a lawyer working for the big timber firm J.D. Irving, Limited.

“During the shoulder seasons, heat pumps are two to three times more efficient,” Clark said, quickly adding that during the coldest periods, “they’re almost the same as baseboard heaters.”

Like many ratepayers, JDI isn’t pleased about having to pay lots more for power, given that its businesses – everything from toilet paper to french fries – are so energy intensive.

For several days this summer, interveners representing various interests have been questioning NB Power officials at the rate hearings to decide if the public utility should be allowed to jack up electricity prices for households and businesses close to 20 per cent over the next two years.

Wednesday was no different, with three different lawyers asking questions on everything from NB Power’s planned, $113-million revamp of its software systems over the next several years to its decision to sell its old and new headquarters in Fredericton, leasing back the newer building.

Lepreau is a black hole and they just keep throwing money down it. Mothball it and buy the power from somewhere else.

Mario Levesque

Mario Levesque wonders if it will make a difference.

The political science professor at Mount Allison University says the regulatory process is important and drilling down on the details is crucial to coming up with fair prices.

But he thinks NB Power’s biggest problem is with the public, wary after so many boondoggles.

“For the public, they want competitive rates with their neighbours, and even with the increase, that’s not the issue at hand,” he said. “For the public, they don’t have any trust in NB Power. That’s the bigger issue.”

Levesque itemized various NB Power projects that were much more expensive than they had to be, and in some cases, completely unnecessary.

In 1968, NB Power commissioned the Mactaquac Generating Station near Fredericton, but in the construction of the concrete spillway and gates, used inferior rocks that undergo a chemical reaction and expand over time. It was a phenomenon known to engineers for decades. Part of the reason NB Power wants a $7.2-billion retrofit is to help fix that problem only halfway through the plant’s design life.

There was the Orimulsion fiasco, when NB Power converted Coleson Cove in Saint John in 2002 to burn the cheap Venezuelan fuel without having a signed contract, only to discover that the dictatorship in power in the South American country refused to come good. The project cost ratepayers hundreds of millions.

More recently, there was the Joi Scientific debacle. The utility dumped $6.5 million into the Florida company, which claimed it had technology to generate hydrogen gas from seawater to generate electricity on demand.

The project fizzled, and ratepayers’ money went down the drain.

But NB Power’s more recent financial troubles have been caused by the Point Lepreau Nuclear Generating Station, first opened in 1983, near the Port City.

NB Power refurbished the nuclear side of the plant in 2012, at a cost of $2.5 billion, a project that was over budget by $1 billion and took 37 months longer to complete than expected. But the utility didn’t do similar work to other important parts of the plant, on the conventional side, leading to frequent breakdowns.

According to NB Power’s own documents, among nuclear peers, Lepreau’s performance is consistently near the bottom.

“If they can’t do Lepreau right, what are they going to do with Mactaquac?” Levesque said. “It’s one blunder after another. They have a really poor track record overall on being on time, on budget.”

NB Power insists it is being more careful with both plants now, taking the time to get their rehabilitations right and investing enough money to ensure they perform well.

It also keeps coming back to the need for baseload power – the kind of energy that 1,200 megawatts the two plants provide, combined, enough to serve over 200,000 households. During the coldest moments, Lepreau in particular is badly needed, they say.

Levesque isn’t convinced. He points to the Netherlands, which was forced to quickly come up with energy solutions after Russia invaded Ukraine and its natural gas supply was threatened.

One in three homes in the European country now have rooftop solar panels, and commercial factories, with vast, flat roofs, are also cashing in on the trend.

“Lepreau is a black hole and they just keep throwing money down it. Mothball it and buy the power from somewhere else,” the professor grumbled. “The Netherlands are taking advantage of all that free roof space. And they actually have solar panels on lakes, floating on the water. That’s innovative, but we’re stuck in an old economy here.”

Point Lepreau has a generator 'issue,' says NB Power

Utility doesn't know how long it will take to fix

There’s a problem with the generator at the Point Lepreau nuclear power plant, and NB Power says it doesn’t know how long it will take to fix, or how much it will cost.

The aging facility provides about one third of New Brunswick’s electricity, but has been plagued with problems in the last few years.

“We are currently on day 94 of the planned 100-day outage at the Point Lepreau Nuclear Generating Station,” NB Power spokesperson Dominique Couture said in an email to Brunswick News.

“After successfully completing planned maintenance work for the spring 2024 outage, an issue was identified in the generator, which is on the conventional, non-nuclear side of the station, as it was being returned to service.

“The team, along with a number of industry equipment experts, are currently troubleshooting the problem. After investigation and troubleshooting is complete, we will have a better understanding of the impact on the outage schedule and budget.

“It is important to note that there are no health or safety concerns related to this delay.

“During the outage, the team accomplished a great deal, including replacing key equipment to enhance the reliability of the Station, safely completing over 25,000 tasks to ensure improved performance moving forward.”

In an April 5 press release announcing the 100-day shutdown, NB Power said its “unwavering commitment to reliable generation serves as the cornerstone of our efforts to ensure energy security for New Brunswick.”

“These maintenance outages are vital to continue safe, reliable and low-emitting electricity generation that meets the needs of our customers. The timing for the maintenance is chosen to align with New Brunswick’s heating season needs,” the release read.

“Activities will include inspections and the installation of upgraded equipment on both the nuclear and conventional sides of the Station, benefiting its long-term reliability. Post-maintenance testing will precede a seamless return to full operation.”

At that time, Couture told Brunswick News that it would cost $86 million to replace the energy lost during the shutdown. And in terms of capital spending, Couture said, the job would set the utility back $137 million, spread out over two years, for a total of $223 million.

News of the shutdown possibly needing to be extended comes as the New Brunswick Energy and Utilities Board (EUB) considers NB Power’s request for the highest rate hikes for its customers in generations. It is seeking increases of 23 per cent for residential and big industrial customers over the next two years, slightly less for small and medium-sized businesses.

Appearing before the EUB, NB Power CEO Lori Clark argued that breakdowns at Point Lepreau were one of the main reasons her organization couldn’t pay down debt, a situation it hopes to address by investing more in annual maintenance and repairs.

Every time the plant has an unscheduled outage, the utility is forced to pay for expensive power from out of province or run other generators, otherwise people would experience brown-outs or rolling blackouts, she said.

And during the pandemic, NB Power decided to freeze electrical rates to help its customers cope. “In hindsight, I don’t think it was the right thing to do,” Clark said. “But at the time, it was the right thing to do.“

NB Power refurbished the nuclear side of the plant in 2012, at a cost of $2.5 billion, a project that was over budget by $1 billion and took 37 months longer to complete than expected. But NB Power didn’t do similar work to other important parts of the plant, leading to frequent breakdowns.

While most Candu reactors around the world operate close to 90 per cent of the time, Lepreau’s average over the last five years has been 78 per cent. That ends up costing ratepayers tens of millions in replacement power and repairs.

– With files from John Chilibeck

Editorial: Perceived conflict for ex-energy minister

There’s something amiss about former Tory cabinet member Mike Holland taking on a high-level sales gig with the company formerly known as SNC-Lavalin – immediately after leaving office as the provincial energy minister.

His appointment with the newly renamed AtkinsRéalis – a major player in nuclear power – creates the perception of conflict.

To start, some caveats: On the whole, Holland did a fine job in his ministerial role. And we appreciate that people need to earn a living after politics. Private sector work is certainly preferable for taxpayers compared to “golden handshakes,” allowing outgoing politicians and top aides to get paid out while sitting around doing nothing.

Still, it’s worth asking: why Holland? After all, he did not come to provincial politics as a nuclear expert. The experience the company has pointed to in support of his recruitment was attained as a public official.

And even then, we’re dubious of what he’s being hired to do. Provincial conflict-of-interest laws prevent a former official from lobbying the government within a year of leaving office. Yet with a provincial election coming no later than the fall, and much of the political machinery slowing down, that one-year period will very soon be over.

New Brunswick is also one of only two provinces that operate nuclear power plants as part of their power grids. And both the provincial government and NB Power have enthusiastically included small modular reactors in their plans – another space this company is playing in.

We worry Holland is being retained to peddle influence he may continue to have among a re-elected Higgs government – on behalf of a Quebec company that may compete with New Brunswick firms receiving public funding.

Whatever Mr. Holland’s intentions, cases like this reinforce negative perceptions of our elected officials – smoothly sliding into private roles that leverage their credentials of power, and with unclear outcomes for the public interest.

Second review of ARC’s SMR not complete, despite layoffs

That’s after ARC Clean Technology Canada said it downsized with that review now over

A second design review of a New Brunswick-based company’s proposed small modular nuclear reactor is not yet complete, according to the Canadian Nuclear Safety Commission.

That’s after ARC Clean Technology Canada said it downsized with that review now over.

Brunswick News reported last month that ARC, one of two companies pursuing SMR technology in the province, had handed out layoff notices to some of its employees, citing its latest design phase coming to an end.

That’s as its CEO also departed.

But the Canadian Nuclear Safety Commission says it’s “months” away from completing its review, and may need more information from the company.

“We have received all of ARC’s major submissions as part of the vendor design review process and our experts are carefully reviewing them,” commission spokesperson Braeson Holland told Brunswick News.

“It is possible that staff will have additional questions for the vendor. In that case, additional information may be requested, and the company will be expected to provide it for the vendor design review to proceed.

“Provided that any additional information requested is submitted in a timely manner and that the company remains in compliance with its service agreement with the Canadian Nuclear Safety Commission, we anticipate that the review will be complete within several months.”

A vendor design review is an optional service that the commission provides for the assessment of a vendor’s reactor design.

The objective is to verify, at a high level, that Canadian nuclear regulatory requirements and expectations, as well as Canadian codes and standards, will be met.

The company did complete a Phase 1 review of its ARC-100 sodium-cooled fast reactor in October 2019.

An executive summary of that review, made public by the commission, noted that there were requests for additional information, as well as technical discussions through letters, emails, meetings and teleconferences, after an initial submission.

The result of that first review found that “additional work is required by ARC” to address findings raised in the review, specifically around the reactor’s management system.

It then lists a series of technical concerns, but concludes that “these issues are foreseen to be resolvable.”

A Phase 2 design review, which ARC is undergoing right now, goes into further detail, and focuses on identifying fundamental barriers to licensing for a new design in Canada, according to the commission.

That review started in February 2022, and was expected to be completed in January of this year.

It’s unclear why it has yet to be completed.

At a New Brunswick Energy and Utilities Board hearing last month into a recent power rate hike, NB Power vice president Brad Coady testified he doesn’t expect SMRs will be ready by an original target date of 2030.

The utility now believes they’ll be ready by 2032 or 2033.

Coady said that’s, in part, due to regulatory hurdles.

“Simply put, where we are in the license-to-prepare-site application and the environmental impact assessment, it is unlikely that we can construct and operate a small modular reactor by 2030,” he said.

ARC has maintained that its Phase 2 review is nearing its end.

“Following the substantial conclusion of our work to complete Phase 2 of the vendor design review process with the Canadian Nuclear Safety Commission, ARC Clean Technology is re-aligning personnel and resources to strengthen our strategic partnerships and rationalize operations to best prepare for the next phase of our deployment,” the company said in a statement.

“In parallel, Bill Labbe, ARC Clean Technology Canada President and CEO since 2021, has announced that he will transition to a new opportunity in coming months.”

The Canadian Nuclear Safety Commission stated that the results of its review will be made public when completed.

Editorial: Utility must find cost savings

The provincial power utility must look at ways to cut costs, and not just push for higher rates and longer debt repayment schedules.

NB Power is applying for a big electricity price increase. At issue are not just the standard inflationary pressures of the moment, but a generational shift in energy patterns. Much of the world, including Canada, is aiming to reduce fossil fuel use. More energy consumption will move to non-emitting electricity.

That means that utilities are all under pressure to generate more power, more reliably, in a more environmentally sound way.

This is challenging enough.

For NB Power, there is an even deeper problem: substantial debt on the order of $5 billion, and a looming multibillion-dollar refurbishment of its biggest hydroelectric generation station at Mactaquac.

In discussions at the hearings on the proposed rate hike, debate has focused on the impact of NB Power’s finances on the provincial credit rating. The Province of New Brunswick is, after all, the entity that owns NB Power and will be left holding the bag if NB Power can’t pay down its debt. The province has directed the utility to pay down a billion dollars of its debt by 2029. NB Power’s CEO suggests that a longer payback period would reduce the pressure on rates. There is, however, another path: reducing the utility’s expenses.

Crown corporations can be notoriously resistant to the idea that they can reduce their costs without reducing their output. But such things are not just possible, they are essential to ensure value for taxpayers and ratepayers alike.

To receive the requested hike to rates, NB Power must show it can’t cut costs. We, however, believe there is more room for savings on this front.

NB Power seeks approval for big spending after money is already spent

Public utility says catastrophic failure at Bayside gas-powered plant in Saint John forced it to make an emergency decision

There is one big oddity to the hearings that will decide if NB Power can raise electricity prices to the highest in generations.

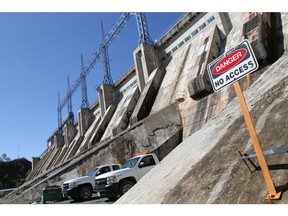

Besides the large rate request, the public utility is also asking permission to spend more than $50 million on emergency turbine replacement for one of its power plants, a job that has already been completed.

The law spells out that NB Power must seek approval from the New Brunswick Energy and Utilities Board, an independent regulator, if it estimates it will spend more than $50 million on any capital project.

Under the province’s Electricity Act, the board must carefully consider NB Power’s big spending projects and reject them if the evidence shows they will unnecessarily drive up rates for households and businesses.

But the Bayside natural gas plant in Saint John suffered a catastrophic failure on Jan. 24, 2022, and was out of commission for a year.

NB Power used a provision in the law that allows it to immediately embark on such expensive work in the case of an emergency and seek retroactive approval from the board for heavy spending.

NB Power CEO Lori Clark told reporters after testifying at the hearing that NB Power officials initially thought a piece of ice went through the turbine and caused the blades to fail.

“So, something we hadn’t planned and obviously caused a catastrophic failure at the station that we couldn’t have anticipated.”

In NB Power’s filing of evidence to the board, there’s no mention of ice.

Instead, the document about its general rate application states that one of the compressor blades broke off and damaged more than one-third of the other blades in the turbine.

It was due to a manufacturer’s defect.

“From the study work conducted by NB Power, it was believed to be a manufacturing defect (crack) in the blade on the stator row 3 that propagated and failed and sent a part of the blade through the machine causing it to go offline due to automatic protection activation,” the report states. “This resulted in the station being taken out of service for a prolonged period.”

Yet only three years before the catastrophic failure, NB Power boasted in a media release that it had made a great deal by purchasing the plant for $46 million from the private firm Emera. Up until then, NB Power had been buying the power produced by the old, 280-megawatt gas-fired plant on Saint John’s industrialized east side.

“NB Power completed its due diligence by engaging an independent third party to carry out an inspection and the company was impressed with the station’s condition and capabilities,” states the release from March 6, 2019. “Bayside underwent extensive renovations in 2017 which included repairs, and replacement of major turbine components. Major capital projects have restored the combustion turbine to like-new condition.”

The New Brunswick Energy and Utilities Board must decide if NB Power

should be allowed to spend more than $50 million on replacing a gas

turbine at its Bayside plant in Saint John – after it already spent the

money.Photo by John Chilibeck/ Brunswick News

The New Brunswick Energy and Utilities Board must decide if NB Power

should be allowed to spend more than $50 million on replacing a gas

turbine at its Bayside plant in Saint John – after it already spent the

money.Photo by John Chilibeck/ Brunswick News

NB Power made the purchase after securing a long-term deal for natural gas out west.

In its filing, utility officials said they only had three options: decommission the plant, repair it, or replace the turbine, a project that had been planned for the following year anyway, with the hopes of extending the life of the generating station.

Repair work, it said, would be costly – $47 million for difficult-to-source replacement parts and proper inspections – and quickly ruled out. Decommissioning, it added, was never really an option because of the plant’s importance.

Of New Brunswick’s big thermal plants, it belches out the fewest greenhouse gases, unlike Coleson Cove in Saint John, which relies on heavy oil, and Belledune, which uses the biggest polluter of them all, coal.

And executives at the public utility say Bayside is essential for providing enough baseload power to ensure people’s lights and heat stay on in the cold winter months.

We need to have energy security in New Brunswick. We’ve seen rolling blackouts in other provinces and we certainly don’t want to be there.

Lori Clark

The document refers to the frosty morning of Feb. 4 last year, when a brief but powerful Arctic airmass caused low temperatures and gusty winds, making much of the province feel colder than –40 C.

“NB Power experienced an all-time peak event in response to a population surge and one of the coldest periods experienced in the last 20 years,” the document states. “If Bayside was not operable on that date, and due to the lack of market energy from neighbours, it is likely that NB Power would have had insufficient generation to meet demand if Bayside was not returned to service in time for this peak event.”

When speaking to reporters earlier this week, Clark said NB Power couldn’t leave customers in the cold and dark.

“We need to have energy security in New Brunswick. We’ve seen rolling blackouts in other provinces and we certainly don’t want to be there.”

NB Power says it had originally estimated that replacing the turbine would be $48 million, just under the $50-million threshold for seeking special permission.

In the end, though, the cost was closer to $67 million, due to an unanticipated two-and-half-month delay caused by workers who didn’t show up for the job and parts that didn’t come in on time. NB Power says the big bill was offset by a successful insurance claim and the sale of old parts that dropped the overall pricetag to $52 million.

It’s difficult to know what the three-member board thinks of what happened at Bayside and whether they will grant approval for the big spending after the fact. Their decision isn’t expected for months.

NB Power spokesperson Clayton Beaton wouldn’t speculate what would happen if the board rejected the spending.

“It would be premature to comment on that scenario as we are currently before the Energy and Utilities Board,” he wrote in an email. “NB Power looks forward to receiving the EUB’s decision on this matter.”

Meanwhile, board chairperson Christopher Stewart asked senior NB Power executives twice at the hearing on Tuesday whether in the future, they’d consider seeking pre-approval for projects that are just under $50 million, given that costs can sometimes inflate.

Darren Murphy, NB Power’s chief financial officer, said they could, as a minimum, provide details to the board ahead of time.

“We certainly are happy to provide information,” Murphy said.

Seemingly unsatisfied with that response, for the third time, the chairperson asked the same question.

“Your intention at this point is to only bring those projects which you believe, at the outset, not after the fact like Bayside, will exceed the $50-million threshold?”

To which, Murphy responded: “That’s correct.”

Credit agencies watch as NB Power seeks highest rates in generations

Questions are raised whether huge debt repayments could be spread out to avoid households and businesses paying far more for electricity

One of the Higgs government’s cardinal concerns has been cited repeatedly in a rate hearing that will decide if NB Power can raise electricity prices the highest in generations.

The provincial government’s excellent credit rating.

Officials at the hearing in Fredericton, such as the public intervener and the legal team for the private timber firm J.D. Irving, Limited, have asked NB Power executives repeatedly why the utility can’t extend the period for paying down $1 billion in debt.

They point out that if debt repayment were spread out over more years, rates for NB Power customers wouldn’t have to go up as high over the short term.

As it stands, the Progressive Conservative government has directed NB Power to pay down a huge portion of its $5-billion debt by 2029.

This is one of the reasons why NB Power wants to raise rates 9.8 per cent this year and another 9.8 per cent next year for households, and even more for big industry.

If granted, they would be the highest hikes in more than 40 years.

The interveners have circled back to an overriding concern of the Tory government – the importance of maintaining good standing with the world’s most important credit rating agencies.

If I were only looking at the customer impacts, I would push it out as long as I can.

Lori Clark

Earlier on at the hearing this week, Glenn Zacher, a lawyer for JDI, drew out of NB Power CEO Lori Clark that she was pleased when the Higgs government suddenly announced last September that it was extending the period for the big debt paydown, giving the utility an extra two years.

NB Power officials had warned the government that without an extension, double-digit rate hikes would have to be foisted on households and businesses.

“In light of your evidence that you were relieved and welcomed the extension from 2027 to 2029 because of the mitigative effect it had on customers, why did you not consider an extension beyond 2029 for the same reason?” Zacher asked.

Clark said she did not consider spreading out the debt repayment further because the government’s directive was only to extend it by two years. Even though hitting the 2029 target is not a requirement by law, she said NB Power couldn’t just ignore government directives.

“If I’m only looking at the impact on customers, I would have pushed it out as far as I could,” the CEO said. “The challenge is we also have to look – I have to look at other things that are impacting the utility.”

Clark said NB Power was preparing to spend big money ensuring people have reliable service, in an era when electrical demand is growing heavily and Ottawa is putting in new, stricter regulations for utilities to curb greenhouse gases and combat global warming.

“We are just running out of time to do that,” she said. “If I were only looking at the customer impacts, I would push it out as long as I can. Unfortunately, I can’t just look at one dimension when you make these types of decisions.”

The big agencies have upgraded New Brunswick’s credit rating since the Higgs government paid down $2 billion in provincial debt and maintained balanced budgets for its entire time in office since 2018, the only Canadian province to do so.

The ratings are now near the top, with Moody’s giving AA, Standard and Poor’s an A plus, and DBRS an A high to New Brunswick, according to their own rating systems. Only the federal government and British Columbia have better ratings. The higher ratings lead to savings on interest payments. The debt reduction has also resulted in $75 million in yearly interest savings for provincial taxpayers.

NB Power officials in their testimony explained that the concern about their organization’s shaky finances is twofold – its heavy debt burden of $5 billion, proportionally, could make the credit rating agencies cast doubt on the provincial government’s finances, since it, as NB Power’s exclusive shareholder, would be responsible for mopping up the red ink mess if the utility failed to meet debt payments.

But NB Power also benefits from the lower rate of borrowing the province receives thanks to its excellent credit rating, interest savings the utility wants before it embarks on massive, multibillion-dollar overhauls of crucial power plants at Point Lepreau, Mactaquac and Belledune.

When Zacher pushed NB Power officials on the effect their organization’s finances could have on the province’s credit rating, Darren Murphy, the utility’s chief financial officer, said the province’s auditor general had already delivered a report citing such concern, all part of the evidence before the New Brunswick Energy and Utilities Board.

The three-member, quasi-judicial board listening to the proceedings will ultimately decide how high NB Power’s rates should go.

But in sifting through the evidence from previously filed documents, the lawyer showed Murphy that the provincial government’s rating wouldn’t necessarily go down as long as NB Power showed it was making some kind of progress toward paying down debt.

In other words, the 2029 deadline was not make-or-break.

“So, Mr. Murphy, you in fact agree that as long as the debt-to-equity ratio does not worsen and that there is some progress towards it, that that will likely not result in a down grading of the province’s credit rating?”

The executive answered yes.

But Murphy quickly added that he couldn’t state what other variables the rating agencies might consider if they eventually downgrade the province and hurt its favourable borrowing terms.

“So I can’t say it with certainty.”

https://tj.news/new-brunswick/

Premier’s office not given heads up on ARC staffing changes

NB Power is still banking on SMRs to power the province’s electricity grid in the near future

The Higgs government says it wasn’t given a heads up on the sweeping staff changes at one of the province’s two small modular nuclear companies. SUBMITTED

But it says the millions in public dollars spent on ARC Clean Technology Canada had targets built into the funding that the company met.

Meanwhile, NB Power is still banking on SMRs to power the province’s electricity grid in the near future.

Brunswick News reported earlier this week that ARC president and CEO Bill Labbe is no longer with the company, while an unknown number of other employees were given layoff notices.

ARC confirmed in a statement that it was “re-aligning personnel and resources” in a move to “rationalize operations to best prepare for the next phase of our deployment” after it completed a second vendor design review with the Canadian Nuclear Safety Commission, seen as a deeper dive into the company’s technology design and plans.

That decision raises questions on whether a path to commercialization remains on track.

“We are aware that the technology is still advancing and understand that restructuring is part of that process,” Premier Blaine Higgs’s office spokesperson Laverne Stewart said in an email.

The premier’s office didn’t directly answer if it has been given any assurances from ARC on its ability to still bring an SMR to commercialization.

But on Wednesday it added that “to date, ARC has met the milestones they have committed to meet.”

Stewart also said the office was “not made aware of these staffing changes before they were announced.”

She then defended spending on the technology to date.

The Higgs government has spent $20 million towards efforts to commercialize ARC’s technology, with NB Power planning to add an ARC-100 small modular reactor at the Point Lepreau Nuclear Generating Station.

The federal government has also spent $7 million on the company.

“Both Progressive Conservative and Liberal governments in New Brunswick have invested in small modular reactors because making sure we have energy security in our province is important,” Stewart said. “The funding from the government of New Brunswick was delivered in a very structured fashion contingent on several benchmarks being reached.”

A contract with a small modular nuclear reactor company saw the province pay out all of that $20 million by July 1, 2022.

That contract, obtained by Brunswick News, also specifically called on ARC to “notify promptly of any circumstances that could result in significant delays to the development activities.”

And it put in place a project oversight committee consisting of senior officials from the provincial government, NB Power and ARC with broad-ranging powers to intervene in any major step taken along the way.

Former Energy Minister Mike Holland told Brunswick News last month that the committee still remains in place providing updates.

The premier’s office confirmed that on Wednesday.

“The government created a project oversight committee to make sure that the project continues to move forward,” Stewart said. “We’ll continue to have this committee to monitor progress.”

At a New Brunswick Energy and Utilities Board hearing on Tuesday into a recent power rate hike, NB Power vice president Brad Coady testified he doesn’t expect SMRs will be ready by an original target date of 2030.

The utility now believes they’ll be ready by 2032 or 2033.

Still, the New Brunswick government has a goal, as stated in its 12-year-energy plan, to add 600 megawatts of SMR energy production to the provincial grid by 2035.

Speaking to reporters at the utility board hearing, NB Power CEO Lori Clark declined to comment on the personnel moves at ARC.

But Clark said the goal remains unchanged.

“Our integrated resource plan says we need small modular reactors on our system by the early 2030s and we’re still confident that we can have those,” she said.

N.B. small modular CEO leaves, company cuts staff

Layoff notices were handed out to other employees, Brunswick News has confirmed

The head of one of New Brunswick’s two small modular nuclear reactor firms is no longer with the company.

That’s as layoff notices were handed out to other employees, Brunswick News has confirmed.

ARC Clean Technology Canada’s president and CEO Bill Labbe “will transition to a new opportunity in coming months,” the company acknowledged on Tuesday.

It’s unclear how many other staff remain.

The company says the changes are being made after ARC completed a second phase of a vendor design review with the Canadian Nuclear Safety Commission, seen as a deeper dive into the company’s technology design and plans.

The commission has yet to publicly confirm the completion of that step.

It was originally expected to be completed last January.

“Following the substantial conclusion of our work to complete Phase 2 of the vendor design review process with the Canadian Nuclear Safety Commission, ARC Clean Technology is re-aligning personnel and resources to strengthen our strategic partnerships and rationalize operations to best prepare for the next phase of our deployment,” reads a statement provided to Brunswick News.

“In parallel, Bill Labbe, ARC Clean Technology Canada President and CEO since 2021, has announced that he will transition to a new opportunity in coming months.”

Labbe has not responded to requests for comment.

The company added that Labbe “continues to be a champion of SMRs in general, and ARC in particular, and will continue to support the company.”

That said, the company doesn’t plan to immediately replace him.

“During the next period, a core team remains in place led by Bob Braun, chief operating officer of ARC Clean Technology (in the United States) with the support of executive leaders Jill Doucett and Lance Clarke in Canada,” the company said.

The company didn’t say whether it changes timelines towards the commercialization of its technology.

There are concerns that it might.

Norm Sawyer, a former head of ARC, told Brunswick News in an interview that small modular firms typically don’t lay off staff after completing a key phase of its work.

“Now that preliminary design is done, major design work is required,” Sawyer said, speaking based on his international expertise in the field, and not with knowledge of ARC’s current inner workings.

“If you were to move forward, significant hires would be required.

“If you’re going on hold and have funding, you would be staying at current staffing levels. If you have no funding, you probably would be de-staffing. The latter would be significant as you lose all your expertise and knowledge.”

He added: “In a technology company, your biggest asset is your human resources.”

At a New Brunswick Energy and Utilities Board hearing on Tuesday into a recent power rate hike, NB Power vice president Brad Coady testified he doesn’t expect SMRs will be ready by an original target date of 2030.

The utility now believes they’ll be ready by 2032 or 2033.

The company has faced other hurdles as well.

Brunswick News reported earlier this year that ARC is still in search of a new enriched uranium supplier, after it originally planned to buy from Russia.

That said, former Higgs government Energy Minister Mike Holland told the newspaper that he had been assured there is “a queue for North American enriched uranium and we’re in it,” maintaining the company won’t be shut out.

Firms around the world developing a new generation of small nuclear reactors to help cut carbon emissions have been forced to face a big problem: The only company selling the enriched fuel they need is Russian.

High-assay low-enriched uranium (HALEU) is an integral component of the company’s ARC-100 sodium-cooled fast reactor, as well as a number of other advanced reactors currently in development attempting to achieve smaller designs.

But it’s not as simple as finding that enriched uranium closer to home.

While Canada mines uranium – there are currently five uranium mines and mills operating in Canada, all located in northern Saskatchewan – it does not have uranium enrichment plants.

ARC established its headquarters in Saint John in October 2018.

The Higgs government then spent $20 million towards efforts to commercialize ARC’s technology, with NB Power planning to add an ARC-100 small modular reactor at the Point Lepreau Nuclear Generating Station.

The federal government has also spent $7 million on the company.

The New Brunswick government has a goal, as stated in its 12-year-energy plan, to add 600 megawatts of SMR energy production to the provincial grid by 2035.

Price tag for overhauling Mactaquac could pass $7 billion

NB Power executive cautions it's only a rough estimate, with no final decision to be made until the beginning of next year

The overhaul of New Brunswick’s most important hydroelectric power plant could cost as much as $7.2 billion – a huge amount tied to the unprecedented electrical rate hikes NB Power is seeking.

The startling figure was released reluctantly by NB Power’s chief financial officer and senior vice president Darren Murphy during a rate hearing in Fredericton on Monday.

NB Power has not provided an updated estimate since it embarked on the Mactaquac Life Achievement project in 2016, when it said it would cost between $2.9 billion and $3.6 billion to extend the life of the generation station and dam near Fredericton another 50 years.

Murphy at first told the three members of the New Brunswick Energy and Utilities Board he’d rather not give an estimate, citing the fact that tenders have not come in yet for pieces of the work. He said he didn’t have confidence in providing a reliable figure.

But under persistent questioning from Glenn Zacher, a lawyer working for J.D. Irving, Limited, Murphy acknowledged that with inflation and additional scoping work on the project, it would be one and half times to double the original estimate.

That would amount to between $4.4 billion and $7.2 billion.

The board, an independent, quasi-judicial regulator, will ultimately decide whether NB Power has proven its case that it should get its requested rate hikes.

Although most proceedings over the first two days of the hearings at the Fredericton Delta Hotel were dry, polite and formal, at times the atmosphere was tense, including an argument over whether NB Power’s customers would feel rate shock.

NB Power CEO Lori Clark says putting off rate hikes would just worsen the public utility’s financial position, creating a greater burden for customers in years to come.Photo by John Chilibeck/Brunswick News

NB Power’s three most senior executives – Murphy, CEO Lori Clark and Vice President Brad Coady – appeared as the first panel at the hearing to decide whether the utility should be allowed to raise the average electrical rate by 9.25 per cent this year and the same amount next year.

That’s an average hike only. For instance, households are facing a higher increase of 9.8 per cent, plus a catch-up amount for unexpected costs last year of three per cent, for a total increase of 12.8 per cent as of April this year. Add that to next year’s potential hike, and households could be forced to pay 22.6 per cent more.

Randy Hatfield, executive director of the Human Development Council in Saint John, warned the board that New Brunswick has one of the highest energy poverty rates in the country.

In the absence of a low-income energy rebate, we’re going to find more and more, low-income households falling back onto whether they spend money on heat or eat.

Randy Hatfield

Someone who is energy poor spends six per cent or more of their after-tax income on electricity. In New Brunswick’s case, that’s one in every third person in the province, he said.

Raising electricity rates steeply would be hugely difficult for most of these people, he said, given that most of them already have low incomes and use baseboard electrical heat.

NB Power has some programs to help low-income households, but he said they weren’t nearly enough.

“The glaring hole, the missing piece in a comprehensive energy poverty strategy, is a low-income rebate program,” he told reporters afterward. “That’s available in Ontario, in many of the States in the U.S. and throughout Western Europe. And in the absence of a low-income energy rebate, we’re going to find more and more, low-income households falling back onto whether they spend money on heat or eat.”

Big industrial customers face the highest hikes, this year amounting to slightly more than 15 per cent. JDI, which runs paper and sawmills throughout the province, is a huge consumer of electricity.

Clark said NB Power needs the increases to prepare for future load growth, meet climate change goals, deal with intense weather and worse storms, replace badly aging infrastructure, handle inflation, address supply chain problems and fulfill its financial obligations.

As part of NB Power’s efforts to shore up its finances and prepare for the spending at Mactaquac, among other big projects, it is under pressure from the Progressive Conservative government to wipe $1 billion of debt off its books by 2029.

Zacher pointed out that NB Power had failed to reduce any of its debt since formulating a plan in 2013 to reduce it by $1 billion, despite having $426 million in net earnings since that period.

“So ratepayers, for the next five years, are expected to pay the entire freight,” Zacher said.

But Clark said it was unfair to portray the situation that way. The chief executive argued that breakdowns at the Point Lepreau nuclear plant in Saint John were one of the main reasons her organization couldn’t pay down debt, a situation it hopes to address by investing more in annual maintenance and repairs.

Every time the plant has an unscheduled outage, the utility is forced to pay for expensive power from out of province or run other generators, otherwise people would experience brown-outs or rolling blackouts, she said.

And during the pandemic, NB Power decided to freeze electrical rates to help its customers cope.

“In hindsight, I don’t think it was the right thing to do,” Clark said. “But at the time, it was the right thing to do.”

Glenn Zacher, a lawyer from Toronto representing J.D. Irving, Limited, questions whether NB Power has done enough to contain its costs and solve its $5-billion debt burden.Photo by John Chilibeck/Brunswick News

On Tuesday, NB Power lawyer John Fury asked the panel of NB Power executives whether the JDI lawyer was right to say ratepayers would shoulder the entire $1-billion debt repayment burden over the next five years. Coady said no, and estimated that about half the amount, $500 million or so, would likely come from revenues made from export sales of electricity to markets outside of New Brunswick.

Besides, Clark said the utility could not wait any longer to pay down debt because the upgrades were so badly needed at Lepreau and Mactaquac.

The Mactaquac project alone is expected to take 15 years. It’s already behind schedule, with Murphy explaining that experts had advised the utility to take its time and get the project started right, rather than rushing in.

NB Power asked for tenders on replacing the turbines and other work and expects to make a recommendation on how to proceed to its board of directors at the beginning of next year, with a final cabinet decision six to nine months later. That means work could start in the fall of 2025.

The cost for Mactaquac has exploded.

Alain Chiasson

Alain Chiasson, the public intervener who the provincial government hired to represent the public interest, said the Mactaquac project concerned him. He wonders if NB Power will be able to keep rates at an annual average increase of 4.75 per cent for the three years following the latest hikes.

“The cost for Mactaquac has exploded since 2016,” he told reporters on Tuesday. “It will probably be at least $7 billion or if not more. So, yes, I’m concerned about that.”

At one point in Monday’s hearing, JDI’s lawyer recited sworn testimony from Clark at last year’s rate hearing, when NB Power unsuccessfully asked for an 8.9 per cent increase (the board only gave it a little over half the amount, 4.8 per cent).

He recounted that Clark had described rate shock as an increase of 10 per cent or more, what many customers are threatened with this year.

“Any amount when you’re already struggling to pay for groceries and gas will feel like rate shock,” Clark argued, adding that NB Power has a guiding principle of trying to avoid double-digit increases.

Zacher asked if she wouldn’t agree that the proposed increases were extraordinary.

“They are higher than what you’d normally see,” Clark said. “But these are not normal times.”

NB Power begins quest to raise rates by nearly 20 per cent

Public intervener says he'll do everything in his power to convince independent board not to give the utility such a high hike

Alain Chiasson hopes New Brunswickers won’t have to swallow the biggest electricity price hikes in generations.

The province’s public intervener is preparing for NB Power’s general rate application next week before the New Brunswick Energy and Utilities Board.

“I’m worried people will struggle to pay their power bills,” said Chaisson, who’s an independent intervener appointed by the provincial government to represent the interests of everyday citizens.

“They’ll have to make difficult choices between paying for other things and their power bill. That will have a very significant effect on New Brunswickers if these rate increases are approved.”

The public utility is asking for an average rate increase of 9.25 per cent, backdated to April 1, and another average rate increase of 9.25 per cent for April 1, 2025. But that’s an average of all customer classes, including industrial, small business and residential clients.

For households, the outlook is grimmer. NB Power wants residential customers to pay 9.8 per cent more as of April, and 9.8 per cent next year, for a total of 19.6 per cent. The board already gave NB Power temporary permission to charge the higher amount since April, pending the latest hearing when it must prove its case over the better part of 16 days this summer.

Making matters more difficult, NB Power was already provided a three per cent catch-up increase based on unexpected losses last year.

All told, if NB Power gets what it wants, households will be paying nearly 23 per cent more for electricity next April than they were at the beginning of this year.

The hearings before the independent, quasi-judicial board start Monday and are scheduled to conclude on Aug. 23.

NB Power CEO Lori Clark will be one of the first executives to make a presentation to the board at the Delta Fredericton hotel.

We welcome the opportunity to explain the business decisions to support this rate application in this open and transparent forum.

Lori Clark

She has argued in the past that NB Power’s rates are artificially low because of past government decisions to freeze them or put restraints on how high they could go.

“These hearings are an important part of the independent regulatory process, and we will be answering many questions from interested parties,” Clark told Brunswick News in a prepared statement. “We respect the regulatory process and the role the New Brunswick Energy and Utilities Board plays in ensuring New Brunswickers pay a fair rate for their power. We welcome the opportunity to explain the business decisions to support this rate application in this open and transparent forum.”

NB Power CEO Lori Clark says even with rate increases, electricity prices in the province will remain competitive with its neighbours.Photo by John Chilibeck/ Brunswick News

In the documentation provided to the board, NB Power says rates will remain competitive with other nearby places should it approve the increases.

For instance, it will have lower rates than what’s offered in New Hampshire, Maine, Saskatchewan, Nova Scotia and Prince Edward Island.

However, if the rate hikes go ahead, Ontario and Newfoundland’s electricity prices will suddenly become cheaper than New Brunswick’s. British Columbia, Quebec and Manitoba already have cheaper prices. Alberta wasn’t included on the NB Power chart.

“That being said, NB Power understands the impact of the proposed increase on customers and remains committed to cost minimization,” the document states.

“NB Power is concerned about affordability for our customers as they face a variety of inflationary pressures and recognizes that many customers will be challenged by this proposed increase. The utility will help customers access programs to help them manage their energy use and make alternative payment arrangements.”

But Chiasson said he doesn’t buy NB Power’s arguments. His office has hired two utility experts, Robert Knecht of Industrial Economics in Cambridge, Mass., and Dustin Madsen of Emrydia Consulting in Calgary, to analyze the reams of documents from NB Power.

They will present their findings to the board toward the end of the hearings.

No, they shouldn’t have that increase because it’s unprecedented.

Alain Chiasson

In the meantime, Chiasson will cross-examine the various witnesses, including NB Power executives.

“It’s an unprecedented increase and NB Power hasn’t tested their case. My position is that, no, they shouldn’t have that increase because it’s unprecedented and hopefully we’re going to provide some arguments to the board so that they won’t give the entire increase.”

Holland resigns as Tory cabinet minister, MLA

Ministerial duties will be split between Ted Flemming, Réjean Savoie

Natural Resources Minister Mike Holland has resigned from Premier Blaine Higgs’s Progressive Conservative cabinet and given up his seat as the MLA for Albert.

Holland, who was also the minister of Indigenous Affairs, “will be transitioning to prepare for private sector employment opportunities,” according to a government press release Thursday. As a result of his resignation effective Thursday, Justice Minister and Attorney General Ted Flemming will become the minister of natural resources and energy development as part of a cabinet shuffle.

Meanwhile, Réjean Savoie, minister responsible for the Regional Development Corporation, will become the minister of Indigenous Affairs, the government announced in a news release.

In February, Holland, who was first elected in 2018, announced he didn’t plan to reoffer in the provincial election scheduled for this fall. He told Brunswick News at the time he had accomplished everything he had set out do as natural resources minister and wanted to spend more time with his partner who lives in Nova Scotia.

“I want to personally thank Mike for his service to the province,” Higgs said in a press release Thursday. “He has worked hard, leading several departments with excellence, while being a strong voice for his constituents.”

Holland described his six years in office as an “incredible opportunity.”

“I am incredibly thankful to Premier Higgs for that and will always remember my time as a member of the legislative assembly fondly,” Holland said in the release.

The tone of Holland’s departure is more amicable than the recent exit of Environment Minister Gary Crossman.

In April, Crossman abruptly resigned from cabinet and gave up his Hampton seat, taking a swipe at the new “values” of the Higgs government on his way out. Crossman had already announced he didn’t plan to reoffer in the next election.

Holland and Crossman’s exits are among a recent wave of Tory MLA resignations.

In March, longtime Portland-Simonds MLA Trevor Holder announced his resignation shortly after fellow Saint John colleague Arlene Dunn resigned from cabinet and from her Saint John Harbour seat.

Other Tory MLAs have indicated they’re not reoffering in the next election. Those include Dorothy Shephard, Daniel Allain, Jeff Carr, Ross Wetmore, Bruce Fitch and Andrea Anderson-Mason.

– With files from Andrew Waugh